Strategic Update – Q4 2023

Discipline Funds

NOVEMBER 8, 2023

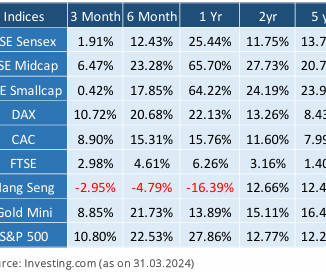

To learn more about our investment management service please contact us here. Macroeconomic Overview Our macroeconomic forecast for 2023 called for a year of disinflation and “muddle through” That means we expected the economy to remain sluggish and for inflation to show positive rates of change that were sequentially slower.

Let's personalize your content