DoL’s Retirement Security Rule & PTE 2020-02 Amendment: What Advisers Need to Know Now About Giving Rollover Advice After Sept 23, 2024

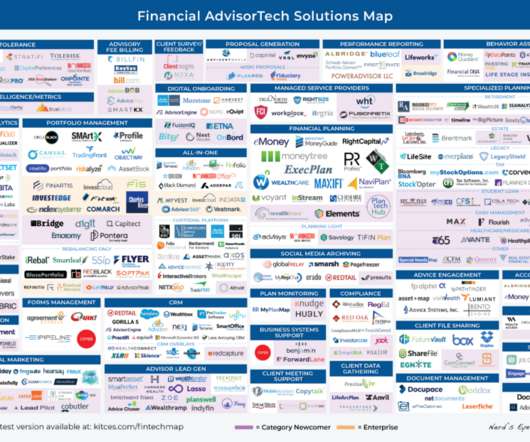

Nerd's Eye View

MAY 15, 2024

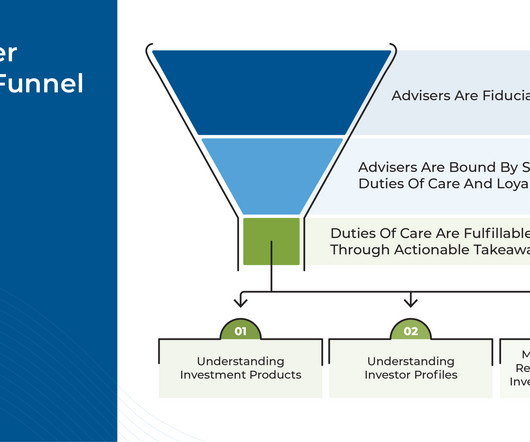

On April 25, 2024, the Department of Labor (DoL) issued the final version of its Retirement Security Rule (the "Final Rule"), which imposes an ERISA fiduciary standard "that applies uniformly to all investments that retirement investors may make with respect to their retirement accounts ".

Let's personalize your content