Opportunity Zone Extension Likely on Hold Until 2025

Wealth Management

APRIL 10, 2024

The program has attracted significant inflows from individual investors looking for tax benefits. A contentious Congress might jeopardize its extension.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Wealth Management

APRIL 10, 2024

The program has attracted significant inflows from individual investors looking for tax benefits. A contentious Congress might jeopardize its extension.

Abnormal Returns

MAY 1, 2024

humansvsretirement.com) Taxes Direct File was a success. Look for it to expand in 2025. wsj.com) How to start preparing for next year's tax season. awealthofcommonsense.com) Taxes matter. (caniretireyet.com) Don't wait too long to spend your money. savantwealth.com) Why would billionaires be willing to do this?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

MAY 31, 2023

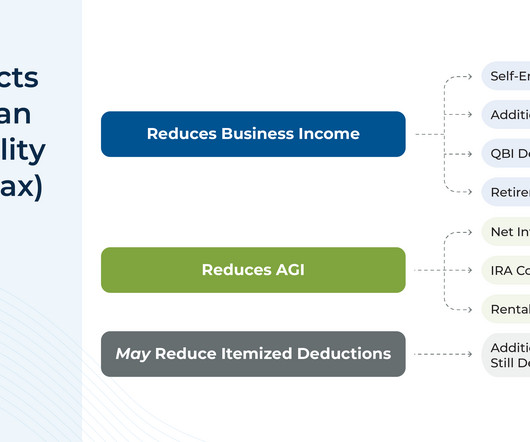

The 2017 Tax Cuts & Jobs Act introduced a $10,000 limit on the State And Local Tax (SALT) deduction that was previously available for taxpayers who itemized their deductions. Another set of considerations involves owners of businesses that operate in multiple states, which can compound the complexity of electing a PTET.

Wealth Management

JANUARY 3, 2024

The 2024 election will play an essential role in determining what is and isn’t on the table for potential 2025 tax reforms.

Covisum

AUGUST 5, 2022

In the absence of Congressional action, multiple provisions of the Tax Cut and Jobs Act (TCJA) will expire at the end of 2025, and tax rules will revert to what they were before the legislation. The TCJA reduced specific tax brackets and increased the standard deduction.

Carson Wealth

FEBRUARY 29, 2024

But when does gifting become a tax issue? Let’s take a closer look at estate and gift taxes and how you can approach them with a financial planning mindset. Taxes on Giving??? Why do you have to pay taxes on money you’re giving away? This continued until the federal government wised up and imposed a federal gift tax.

Advisor Perspectives

OCTOBER 1, 2023

When those changes involve tax law, it is extremely important for clients to meet with their financial professional, tax advisor, and legal advisor to discuss any adjustments that may need to be made to their financial, retirement, or estate plan. My guests today are two members of the MassMutual team.

Advisor Perspectives

SEPTEMBER 27, 2023

When those changes involve tax law, it is extremely important for clients to meet with their financial professional, tax advisor, and legal advisor to discuss any adjustments that may need to be made to their financial, retirement, or estate plan. My guests today are two members of the MassMutual team.

NAIFA Advisor Today

AUGUST 16, 2023

Brought to you exclusively by NAIFA and the Society of FSP, this essential webinar delves deep into the time-sensitive implications of provisions in the Tax Cuts and Jobs Act (TCJA) of 2017 that are scheduled to sunset by 2025.

Abnormal Returns

AUGUST 23, 2023

(wealthfoundme.com) More families are at risk from estate taxes looking out into 2025 and beyond. humbledollar.com) Why QCDs can be so valuable, tax-wise. wsj.com) It's understandable why people put off estate planning. jdroth.com) Retirement You probably need less for retirement than you think.

Nerd's Eye View

NOVEMBER 15, 2023

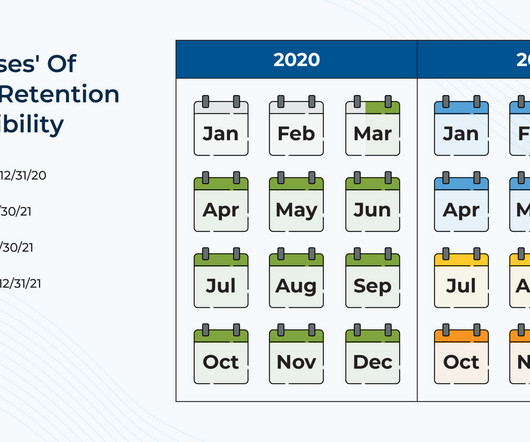

One of these was the Employee Retention Credit (ERC), a tax credit that eligible small businesses could take against their employment taxes.

Wealth Management

FEBRUARY 27, 2024

Here Comes Tax Reform 2025.

Steve Feinberg

MARCH 28, 2022

Parsing any state’s tax code can be a multifaceted and complicated affair, but small business owners especially should understand what types of taxes they are required to pay if they live and operate their company in New Hampshire. What is the Small Business Tax Rate in New Hampshire? Is There a Sales Tax in New Hampshire?

Steve Feinberg

FEBRUARY 3, 2022

At first glance, you wouldn’t think this news matters that much as most small businesses don’t pay Interest/Dividends tax. In 2022 the rate is 5%, and then 4% in 2023, 3% in 2024, 2% in 2025, 1% in 2026, and then completely repealed after 2026. So, what’s changing?

Harness Wealth

DECEMBER 8, 2022

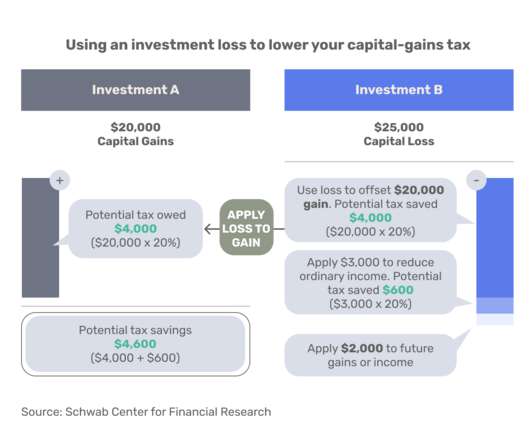

Not only was the stock market fairly volatile, but there were also atypical tax regulation changes. Tax-loss harvesting. Paying taxes on investment gains can be a financial burden, but tax loss harvesting can reduce your bill. You can claim as much capital loss as your realized capital gain plus $3,000.

MainStreet Financial Planning

JANUARY 17, 2024

All families with students who will be starting or continuing college in the 2024-2025 school year should complete the new FAFSA. The direct IRS import of tax data and smart question skip technology reduced the number of questions. For some families, this change will mean that you may lose some aid for the 2024-2025 school year.

Carson Wealth

DECEMBER 8, 2023

That must mean it’s time to roll up my sleeves and get to work on year-end financial planning – with an emphasis on 2023 income tax. One consideration this year is that we’re two years from the expiration of the Tax Cuts and Jobs Act of 2017 (TJCA). AGI impacts multiple other tax considerations.

MarketWatch

MAY 31, 2023

JP:7203 said Wednesday it will start producing an all-new electric SUV at its Kentucky plant in 2025. Only some electric and hybrid vehicles qualify for the full $7,500 tax credit or partial credit spelled out in the Inflation Reduction Act largely based on how much of their manufacturing was U.S. Toyota Motor Corp.

Mish Talk

NOVEMBER 21, 2022

This will be financed from “a broad donor base” and “mosaic of solutions,” such as international development banks and taxes on aviation, shipping and fossil fuels. Coal accounts for 60% of China’s power generation, and more new coal plants are set for approval through 2025 than the entire existing U.S. it won’t commit climate suicide.

Integrity Financial Planning

AUGUST 11, 2022

2 Factor in Taxes. While some people think their tax bill will decrease substantially in retirement, this isn’t necessarily the case. If you have a substantial amount saved in a tax-deferred retirement account, you’ll need to think long-term about taxes. 3 Make an Appointment with a Trusted Financial Professional.

Your Richest Life

JANUARY 20, 2023

Before this change, matches on employer plans were pre-tax. Now, you can make these contributions after taxes, which means the earnings can grow tax-free. The first 4 withdrawals per year would be exempt from taxes and penalty fees. Additionally, effective immediately, employers can offer Roth account matching.

Darrow Wealth Management

DECEMBER 23, 2022

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. In the new bill, the age when retirees must begin drawing from non-Roth tax-deferred retirement accounts would increase to 73 in 2023 and 75 in 2033. Unfortunately, this may not be finalized until 2025.

MarketWatch

FEBRUARY 16, 2023

BP, meanwhile, said it expects the deal to add to EBITDA immediately, referring to earnings before interest, taxes, depreciation and amortization, which is expected to grow to around $800 million by 2025, underpinned by investment, integration value and synergies.

Carson Wealth

DECEMBER 27, 2022

The SECURE Act of 2019 made sweeping changes to required minimum distributions , with the most prudent change being that most non-spousal inherited retirement accounts are required to be withdrawn over 10 years rather than stretching distributions out to avoid heavy tax liabilities. The SECURE 2.0 Another major RMD changes: The SECURE 2.0

eMoney Advisor

JANUARY 20, 2023

Third, it should reflect that there are special catch-up contributions for employees aged 60-63 beginning in 2025. We’ll be taking an in-depth look at recent tax law updates for 2023, focusing on SECURE 2.0 Register now for the 2023 Tax Legislation Insights, Secure 2.0 and eMoney Analysis (1 CFP® CE Credit*) webinar.

Darrow Wealth Management

JANUARY 9, 2023

was signed into law December 29th, 2022, bringing more major changes to tax law. Amount rolled over is tax-free (not included in beneficiary’s income) and penalty-free. Currently, pre-tax or Roth contributions are allowed. Before the passing of the Act, employer funding could only be pre-tax. The Secure Act 2.0

Harness Wealth

JUNE 23, 2023

Furthermore, estate planning includes aspects such as tax minimization strategies, asset protection, and charitable giving. As you navigate the complexities of tax and financial planning for estate planning, a wealth manager or financial planner can offer invaluable assistance to optimize your financial strategy for future generations.

Good Financial Cents

JANUARY 26, 2023

The software maximizes your returns with tax loss harvesting and helps you to reach your specific retirement goals with RetireGuide. For example, if you earn 10% on your investments, but you’re in the 30% tax bracket, your net return is only 7%. You should maximize your tax-sheltered retirement contributions.

Trade Brains

JANUARY 25, 2024

billion at a CAGR of 9% between 2021 and 2025. The domestic electrical equipment market is expected to grow at an annual rate of 12% to reach US$ 72 billion by 2025. In FY21 the rise in NPM was due to an increase in exceptional items and a change in deferred tax treatment. 13,606 crore (US$ 1.6

Random Roger's Retirement Planning

APRIL 23, 2024

The plan is to create a futures contract based on DSPX in Q1 2025 which could then be a path to some sort of exchange traded product. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

Trade Brains

SEPTEMBER 20, 2023

lakh tons, with a total market opportunity of up to 60 billion dollars until 2025. This gives the company a market opportunity of up to $60 Billion until 2025 Weaknesses of the Company The company is dependent on municipal authorities for a substantial portion of its revenue. crores in March 2021 to ₹119.31 crores in March 2023.

Cordant Wealth Partners

OCTOBER 25, 2021

Second, what’s the magnitude of the tax benefit from deferring income? Intel SERPLUS Contribution Scenario and Tax Calculator (excel download). It must be at least three years in the future, so 2025 or later for this year’s elections. The first year available is 2025. The first year available is 2025.

Carson Wealth

FEBRUARY 26, 2024

I do my best to ensure that prior planning is taking place early on whether it is to avoid unprepared heirs or if it is something more like planning to minimize estate taxes. What if there were tax benefits to doing so? So I want clients to ponder what they envision their wealth, financial wealth, doing for its end recipient.

Trade Brains

JUNE 25, 2023

to reach $ 6,780 by 2025. to become a $ 330 billion industry by 2025. The table below showcases the improvement in EBITDA margin and profit after tax (PAT) margin for the past few years. During the same period, the domestic industry is expected to increase in value at a much sharper annualised pace of 12.2%

Trade Brains

FEBRUARY 13, 2023

According to AEO 2020, the adoption of fuel cells clean energy is projected to grow from 150 MW in 2019 to 185-200 MW by 2025. Overall, the sector is estimated to grow 14-15% every year between 2020 and 2025, moving the technology towards mass adoption as the cost comes down. Source: MTAR Industries Ltd. during the next five years.

Trade Brains

SEPTEMBER 24, 2023

This growth has been facilitated by several key reforms introduced by the government, including the introduction of the PLI scheme, lower corporate tax rates, simplification of labor legislation, and a greater focus on human capital. This includes a capacity of 2,219 MTPA at Major Ports and 1,132 MTPA at Non-Major Ports by 2024 – 2025.

Trade Brains

DECEMBER 27, 2022

billion by 2025, registering a CAGR of 26.7% during the period of 2020-2025. The promoters and directors along with the company are involved in certain litigations related to criminal, civil and tax proceedings. Going forward, the Indian Packaging Market was valued at USD 50.5

Zoe Financial

DECEMBER 23, 2022

The Wealthy Stay Wealthy Tax-Loss Harvesting Those with wealth want to be smart about the taxes they pay. They often start with tax-loss harvesting around this time of year. Recognize the losses for your tax return. Too many investors miss this easy opportunity to reduce taxes. If so: Sell those positions.

Trade Brains

MAY 17, 2023

It is estimated that 10 percent of India’s GDP will be from the IT sector by 2025, up from 7.4 Profit After Tax (Rs. The company’s international IT services contribute 27 percent of its total revenues and 73 percent of its profits after tax. percent currently. Dividend Per Share (In Rs) FY 18 2,453 192 10.5 FY 20 3743 276 20.25

Trade Brains

OCTOBER 5, 2023

India is anticipated to achieve a total of US$ 65 billion in textile exports by FY 2025-26 due to the revival in global demand and the implementation of crucial initiatives by the government. An increase in net profit margin also implies that the company effectively managed its financial obligations and taxes. of the country’s GDP.

Carson Wealth

DECEMBER 15, 2023

I do my best to ensure that prior planning is taking place early on whether it is to avoid unprepared heirs or if it is something more like planning to minimize estate taxes. What if there were tax benefits to doing so? So I want clients to ponder what they envision their wealth, financial wealth, doing for its end recipient.

Trade Brains

MAY 23, 2023

to $ 1,090 billion by 2025. Thus, India’s commodity chemicals industry is anticipated to touch $137 billion in value by 2025 while the specialty chemicals sector is expected to hit the $148 billion mark. During the same period, the profit after tax grew at a much sharper rate of 27.64% to Rs 256 crore.

Trade Brains

SEPTEMBER 28, 2023

trillion on infrastructure through the NIP over the next five years to reach its goal of a US$ 5 trillion economy by 2025. of total global drone imports and is predicted to be the world’s third-largest drone market by 2025. Profit After Tax (PAT) has improved from 4 Cr in March 2021 to INR 16.5Cr in March 2023. between 2021-26.

Validea

MAY 15, 2023

Because it came out of bankruptcy with a massive net-operating-loss that it carried forward, it isn’t paying taxes on that cash flow which Fine believes will eventually be distributed back to shareholders.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content