Slower momentum heading into 2023

Nationwide Financial

JANUARY 18, 2023

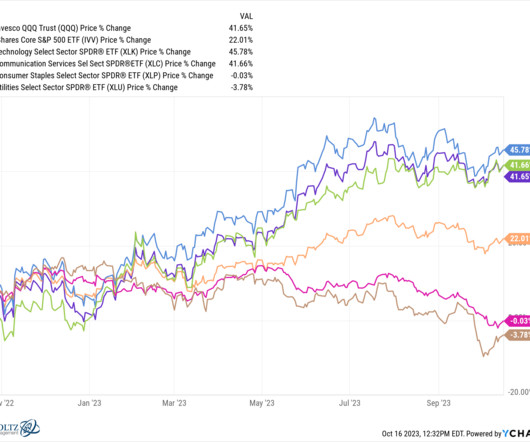

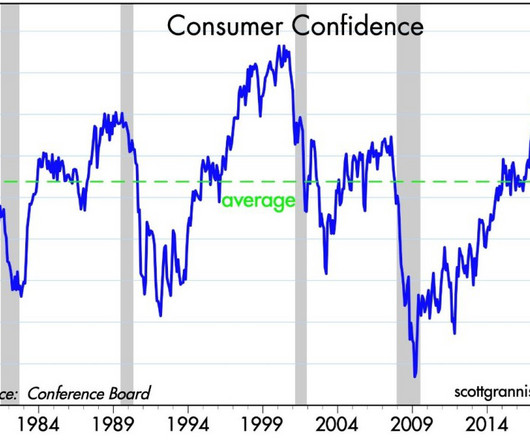

Highlights from the Monthly Review for January 2023: The U.S. economy is in the late cycle period with the Fed responding to rapid inflation with a sharp tightening of financial conditions to slow domestic demand. Financial Markets: Nervousness about 2023 increases investor anxiety.

Let's personalize your content