Wednesday links: ancient asset returns

Abnormal Returns

DECEMBER 13, 2023

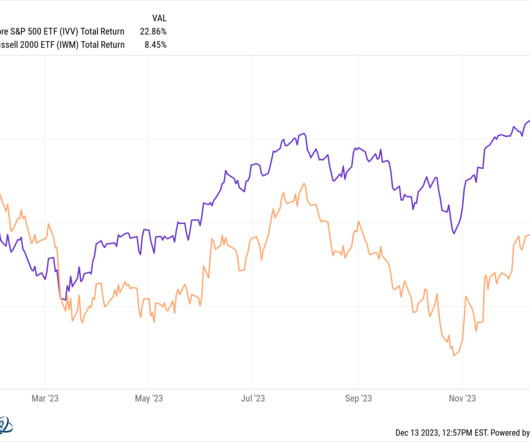

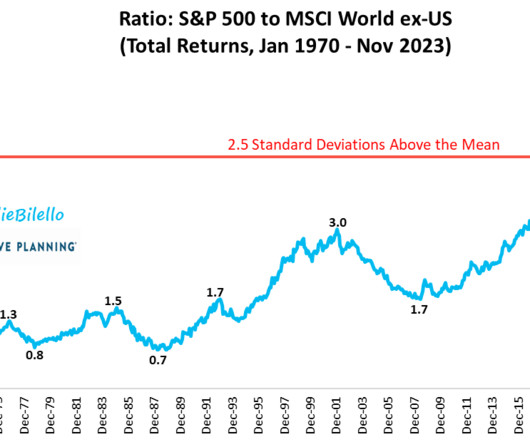

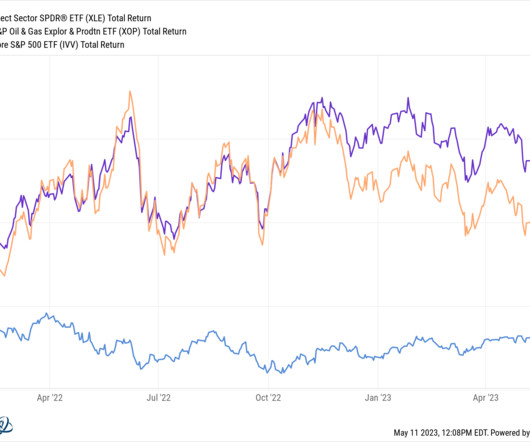

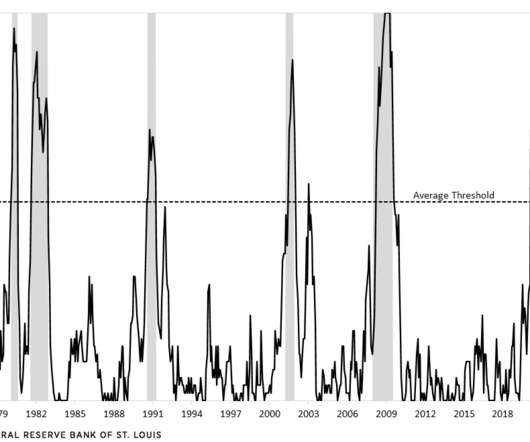

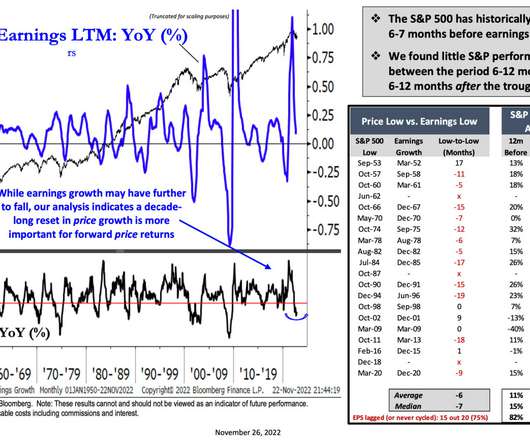

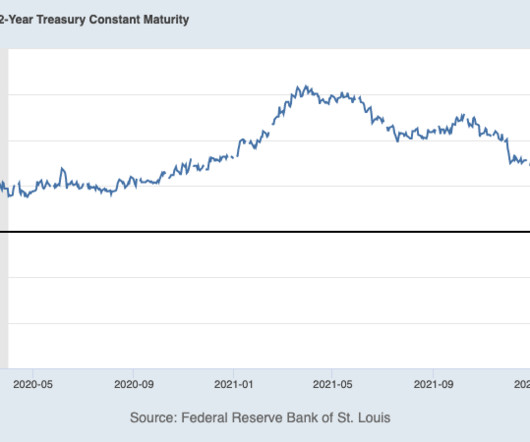

Strategy There's a good chance you need to rebalance your portfolio. bloomberg.com) Some ETF statistics for 2023. etf.com) Economy Real wages are now above pre-pandemic levels. morningstar.com) Bonds outperform bills leading up to a Fed rate cut. carsongroup.com) Apple What's going on with Apple's ($AAPL) Vision Pro?

Let's personalize your content