Financial Market Round-Up – Jul’23

Truemind Capital

AUGUST 12, 2023

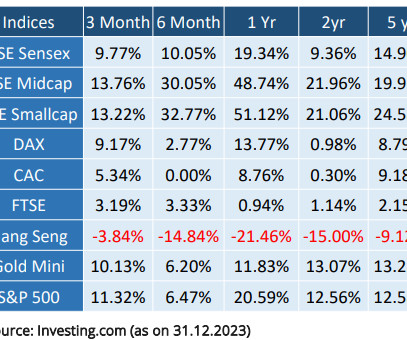

India being highlighted as a beneficiary from the shift in Global equations along with the expected highest economic growth among major economies has attracted strong flows from the FIIs lifting overall market sentiments. The recent rally in the market has made the valuations more expensive compared to historical standards.

Let's personalize your content