The Economy vs. Interest Rates

Bell Investment Advisors

NOVEMBER 6, 2023

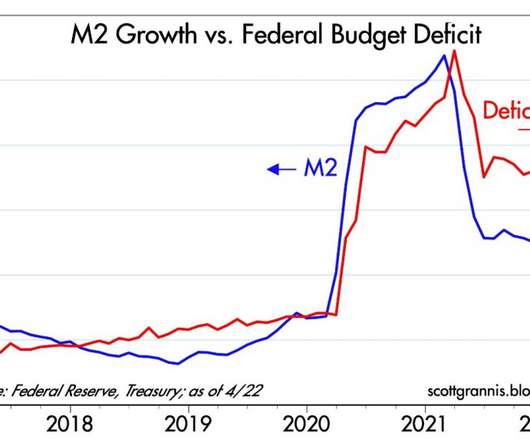

The broader economy surprises, too. First, this is a degree of expansion that is approximately double any quarterly growth rate seen since the post-COVID rebound of 2020 to 2021. With a seemingly unstoppable labor market and an economy that’s defied recession expectations, why have most financial markets declined since July?

Let's personalize your content