Titagarh Railsystems vs Jupiter Wagons – Future Plans & More

Trade Brains

FEBRUARY 14, 2024

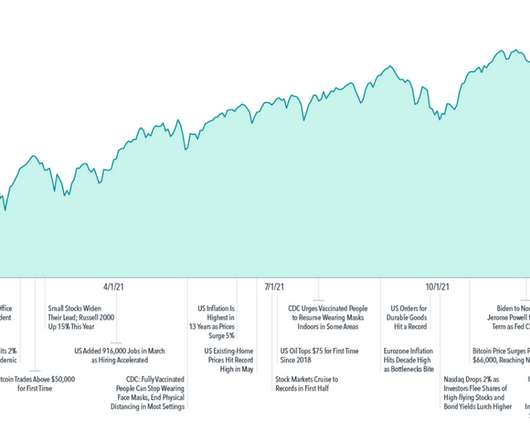

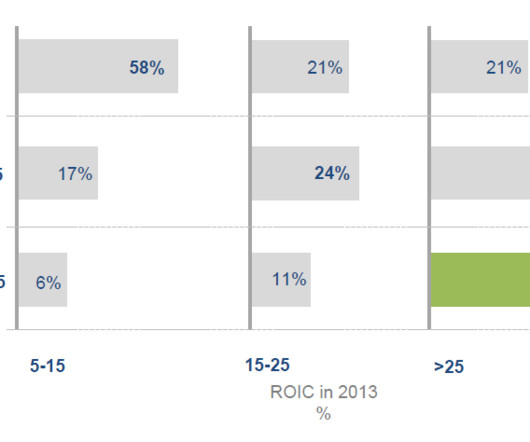

2019-20 ₹ 1,766.32 ₹ 125.74 2019-20 ₹ - 36.14 -₹ 0.13 Particulars/ Financial Year RoCE (%) Titagarh Railsystems Jupiter Wagons 2022-23 16.82% 23.88% 2021-22 8.87% 11.74% 2020-21 4.27% 11.24% 2019-20 1.87% 2.36% 2018-19 1.08% 1.06% Debt Analysis Titagarh and Jupiter’s debt-to-equity ratios in FY23 were 0.71 2019-20 0.36 -0.48

Let's personalize your content