Monthly NFPs Are Rounding Errors

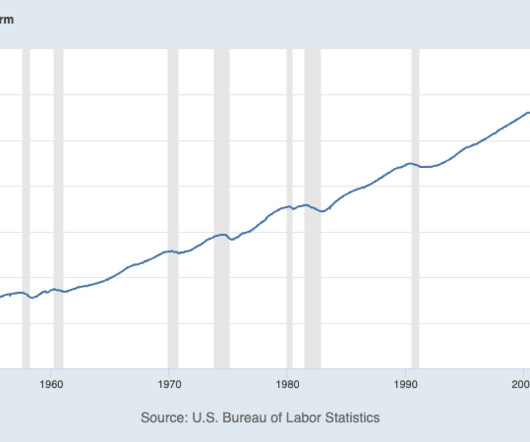

The Big Picture

DECEMBER 8, 2023

workers in the economy that excludes proprietors, private household employees, unpaid volunteers, farm employees, and the unincorporated self-employed. – but most months, the specific number is more or less a rounding error. This is not a popular opinion.

Let's personalize your content