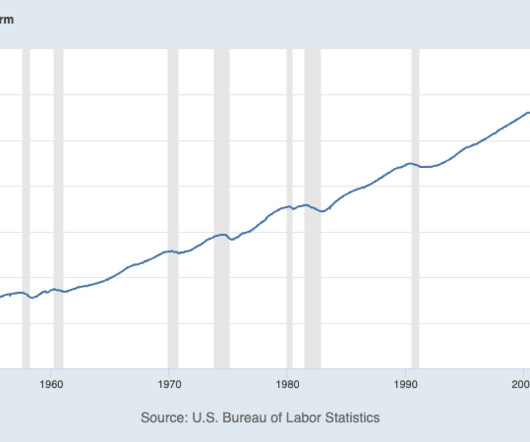

Monthly NFPs Are Rounding Errors

The Big Picture

DECEMBER 8, 2023

June 3rd, 2011) THE MOST IMPORTANT EVER NFP blah blah blah (June 7th, 2013) “What’s Your NFP Number?”

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

The Big Picture

DECEMBER 8, 2023

June 3rd, 2011) THE MOST IMPORTANT EVER NFP blah blah blah (June 7th, 2013) “What’s Your NFP Number?”

Trade Brains

SEPTEMBER 17, 2023

Best Porinju Veliyath Portfolio Stocks: Investors are always on the lookout for small-cap companies which can lead to multi-bagger returns. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. EPS ₹8 Stock P/E 196 RoE 3.2%

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Richer Geek

JUNE 14, 2023

Yip joined APMEX in 2011 and has held roles in Merchandising, Sales, Project Management and Business Development. In this episode, we’re discussing… [1:29] Investing in gold and silver [4:05] Why is diversification important for your portfolio? [6:09] 6:09] What Is Apmex and what is one gold? [19:07]

Random Roger's Retirement Planning

APRIL 4, 2024

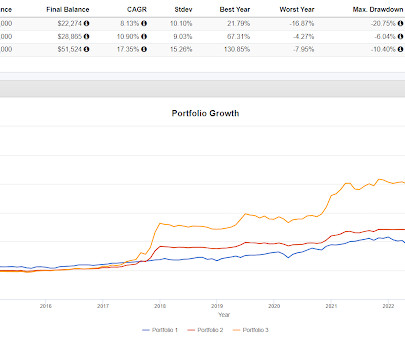

We have a lot of fun here with backtesting portfolios. There was news going around that Daffy.org was adding Bitcoin in 5% or 10% weightings to a couple of its portfolios , presumably to improve returns for otherwise "normal" looking portfolios. The process can be informative but not definitive. It allocates as follows.

The Big Picture

APRIL 26, 2023

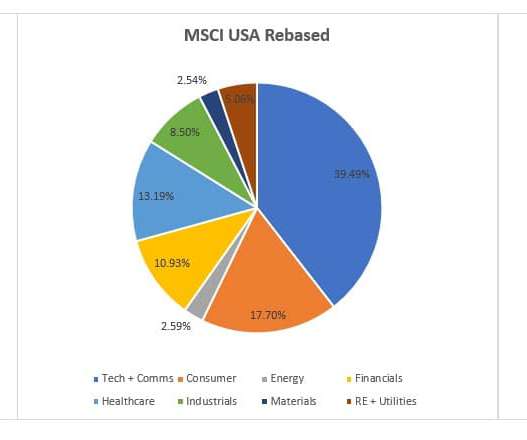

Desmond loved to ask professional portfolio managers “What percentage of stocks would you expect would be making new highs at the top day of the bull market when the Dow Jones was making its absolute high?” He noted that markets get increasingly narrow by cap size (capitalization) as longer secular bull markets approach their ends.

Fortune Financial

AUGUST 16, 2021

One topic I have not touched on in a while is portfolio construction, so I wanted to dedicate this post to the reasons why a sector-neutral portfolio makes sense, and to give investors some ideas for creating their own. The first step is to decide how many positions you want to hold in the portfolio.

Random Roger's Retirement Planning

APRIL 11, 2024

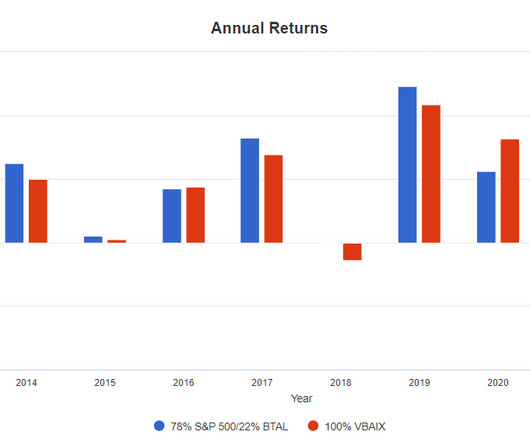

The 2020's have not been lost for managed futures so the same portfolios from 2020 onward. The managed futures blends' worst years in this study were 2011 when they were down slightly versus up 4.31% for VBAIX and 2018 when they were down 5.5%-6% 6% while VBAIX was down 2.84%.

Trade Brains

NOVEMBER 3, 2023

May 20, 2011: Mamata Banerjee became the CM of West Bengal and decided to return 400 acres of land to farmers. June 14, 2011: The govt. June 22, 2011: Tata Motors moves to the Calcutta High Court challenging the bill. October 3, 2008: Tatas announced moving the Nano project from Singur to Sanand, Gujarat.

Random Roger's Retirement Planning

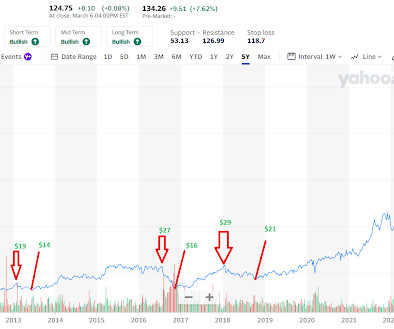

MARCH 7, 2024

Quite a few client holdings have been in the portfolio for more than 15 years. I've owned this stock for clients going back to at least 2011. If you ask most market participants, I think they'd say they are "long term" investors but what does long term mean? There are of course many definitions.

The Big Picture

FEBRUARY 14, 2023

Similarly, excess fees and overtrading are more likely to hurt our portfolios than crashes. We spend far too much worrying about Black Swans than the mundane. Instead of stressing about shark attacks, you should manage your blood pressure and cholesterol.

Random Roger's Retirement Planning

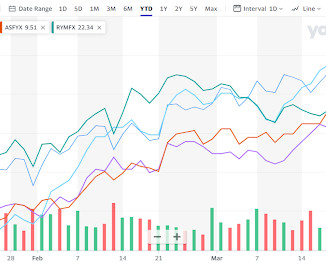

APRIL 9, 2024

Mutiny Funds put out a paper on the hows and whys of using alts for The Cockroach Portfolio that they manage and that we've looked at a few times. Every other year, 2011 forward, the returns were pretty different with the negative correlation standing up more often than not. ASFYX is a client and personal holding.

Trade Brains

SEPTEMBER 28, 2023

In India, while the economy was growing fast, youth unemployment increased significantly between 2011–12 and 2021–22—nearly doubling. Now, that’s a huge number of young, talented people, and a great opportunity for the country to grow its economy with multitalented and skilled youths in this competitive world.

Validea

OCTOBER 19, 2022

Coming into 2022, the 60/40 stock/bond portfolio had been a stalwart strategy for your balanced investor. Even with bear markets like 2000-2002 and 2008-2009, the portfolio had strong returns for a very long period. at the start of the year) things are looking brighter for this simple portfolio. Source: [link].

The Big Picture

FEBRUARY 14, 2024

Full transcript below. ~~~ Previously : Hirsch’s WTF Forecast: Dow 38,820 (September 28, 2010) Super Boom: Why the Dow Jones Will Hit 38,820 and How You Can Profit From It (April 12, 2011) ~~~ Jeffrey Hirsch is editor of the Stock Trader’s Almanac & Almanac Investor Newsletter.

Random Roger's Retirement Planning

SEPTEMBER 18, 2022

More interesting than the articles sometimes are the comments as was the case today with the following comment: What is really wacky is the Modern Portfolio Theory promoted use of bonds in a portfolio.ballast (or theoretical risk-reducing agent). Small allocations don't become impediments to portfolio growth, simply they are laggards.

Trade Brains

JANUARY 23, 2024

Subsequently, the company expanded its product portfolio to include a range of LED lighting solutions, Solar Street lights, Solar-Hybrid Inverters, and LED solar lighting solutions. LEDs In the LED sector, Servotech commenced production in 2011, crafting energy-efficient luminaries for residential, industrial, and commercial use.

Validea

MAY 15, 2023

Likewise, his $5 billion investment in Bank of America in 2011, for 700 million shares at the low price of $7.14, has paid off handsomely, as the stock is now trading around $28. Many of these decisions came about because Buffett knows how to invest not only in companies but also in people, the article maintains.

Validea

AUGUST 9, 2022

While Fleetcor’s June 2018 meteoric rise then fall was a classic example of the effect, research from Standard & Poor’s shows that while the effect was pronounced in the mid-to-late 90s as well as the 2000-10 decade, it all but disappeared in the the 2011-20 decade. Having less “seams” in your index fund portfolio can prevent leaks.

Validea

JANUARY 4, 2023

We’ve been running quantitative model portfolios since 2003. In reviewing the returns for our portfolios in 2022, which were difficult for the markets and investors, things mostly played out as you may have expected as we look back with hindsight, although there are a few surprises and important lessons I think we can draw from the results.

Validea

MAY 5, 2023

Singer has never had much confidence in financial regulators; in 2011 he told The Journal that the Dodd-Frank law allowed the government too much leeway in determining and handling risks in the financial system, something that he sees rearing its head once again in the banking collapses in March. But for long-term prosperity in the U.S.

Brown Advisory

DECEMBER 5, 2016

Dune Thorne is a partner, portfolio manager and head of the Boston office at Brown Advisory, where she helps families and nonprofits develop financial and investment plans to align with their long-term goals.

Trade Brains

MAY 3, 2023

Nexus Select Trust has a portfolio of 17 operational shopping centers throughout 14 major cities, totaling 9.8 Between FY23 and FY25, their Portfolio’s total NOI is expected to expand organically by 26.8%, up from 15.9%. Has a highly stabilized portfolio with committed occupancy of 93.5%. crore in March 2020 to Rs.

Trade Brains

FEBRUARY 11, 2024

Today, it boasts a diverse portfolio encompassing power generation, transmission, and distribution. The company entered into the power sector in 2011-12, by taking over Mahendra Electricals renaming it Torrent Cables Limited, now merged with Torrent Power Limited. Gas-fired plants allow rapid startup supporting flexible operation.

Random Roger's Retirement Planning

OCTOBER 25, 2022

I did have a fairly lucky, partial sale in 2011. Where a small slice was permanently allocated to gold to reduce the portfolio's correlation to the market, gold is being replaced with a small slice to managed futures for the same purpose. I sold RYMFX in Q3 2011. Either way, I've been holding it for 17 or 18 years.

Carson Wealth

AUGUST 7, 2023

The first came in August 2011 from S&P Global Ratings after a government standoff over the debt ceiling. The first downgrade in 2011 did little to change that, and we don’t expect the second downgrade to either. A diversified portfolio does not assure a profit or protect against loss in a declining market.

Trade Brains

SEPTEMBER 20, 2023

Hi-Green Carbon IPO Review : About the Company Hi-Green Carbon Limited was incorporated in 2011, it is a part of the Radhe Group Energy, based in Rajkot, Gujarat, which focuses on renewable energy as its core with a diversified balanced portfolio stretching from castings, consumer goods, corporate farming, packaging and herbal products.

Carson Wealth

MARCH 11, 2024

Near bear markets in 2011 and 2018, a 100-year pandemic bear market in 2020 and then another bear market in 2022 made it anything but an easy 15 years. A diversified portfolio does not assure a profit or protect against loss in a declining market. In fact, the S&P 500 is up more than 900% on a total return basis the past 15 years.

Trade Brains

SEPTEMBER 6, 2023

Net Profit Margin -13.95% Operating Profit Margin -6.25% Delhivery was started in 2011 by Sahil Barua, Mohit Tandon, Bhavesh Manglani, Suraj Saharan, and Kapil Bharati. Its portfolio of services includes a wide range of treatments in the areas of gynaecology, oncology, pulmonology, neurology, cardiac, renal, and more.

Random Roger's Retirement Planning

DECEMBER 22, 2023

With that preamble, I started thinking about the 75/50 portfolio that I first started writing about during the Financial Crisis. I've mentioned 75/50 a couple of times in passing but the big idea was to create a portfolio that captures 75% of the upside of the equity market with only 50% of the downside. ARBFX 3.7%

Trade Brains

MAY 7, 2023

AAVAS Financier Founded in Rajasthan in 2011, AAVAS Financiers Ltd. By utilizing the stock screener , stock heatmap , portfolio backtesting , and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks and make well-informed investment decisions.

Carson Wealth

JANUARY 22, 2024

While our view on the economy leads us to favor stocks over bonds in 2024, we believe bonds are poised to return to their traditional roles as portfolio stabilizers and sources of diversification. A diversified portfolio does not assure a profit or protect against loss in a declining market.

Random Roger's Retirement Planning

DECEMBER 1, 2023

We've also looked at countless ways to incorporate a small allocation to covered calls funds to help reduce portfolio volatility, so using them as alts in a matter of speaking. The portfolio needs to still be managed in decent fashion but it is not the obvious road to ruin that thinking 10% is sustainable would be.

Trade Brains

OCTOBER 13, 2023

This JV was established in 2011 and continues to run smoothly even today. The merger was a win-win for both parties as IDFC Bank was then looking to reduce exposure to its wholesale portfolio. It also own a Mutual Fund Company that offers a variety of Mutual Funds for investors to choose from. Market Cap (Cr.) 10529 EPS 4.71

Clever Girl Finance

OCTOBER 17, 2023

These funds aim to mirror the returns of an index like the S&P 500 , Dow Jones Industrial Average , or the Nasdaq Composite by holding a portfolio of securities that resembles the composition of that index. Created in 2011, it includes exposure to companies like Crown Castle and Public Storage. What makes an index fund low cost?

Darrow Wealth Management

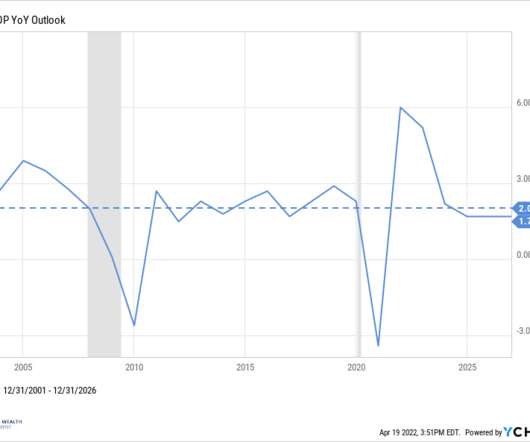

APRIL 20, 2022

In March, US consumer confidence dipped to levels not seen since 2011. Maintaining your lifestyle throughout life is perhaps more about how much income you’ll need in retirement versus the size of your portfolio. Sometimes expectations of inflation can be self-fulfilling, an outcome the Fed seeks to avoid.

The Big Picture

SEPTEMBER 19, 2023

Her job is portfolio and product solutions and that means she could go anywhere in the world and do anything. And so I often would look at investments in my portfolio that may be different from what most other people put in their portfolios. That sounds great, but I only have spots in my portfolio for a Cape Cod.

The Richer Geek

DECEMBER 1, 2021

Then some of that might be in their investment portfolio. And that's why I left in 2011 and became a fiduciary” “On the flip side, I see people with significant amounts of money just sitting in cash at the bank. And so, some of them are in the building phase, and some of them are in the distribution phase.

Trade Brains

OCTOBER 12, 2023

SBI Small Cap Fund may invest up to 35% of its portfolio in other securities, such as debt and money market instruments, as well as other stocks, including large and mid-cap companies. Reliably delivering quality products has been the company’s mission since its inception in 2011. The expense ratio for the fund is 1.77%. EPS (TTM) 31.11

Trade Brains

DECEMBER 10, 2023

In 2011, an Italian company under the name Fabbrica Italiana Lapis ed Affini (FILA) entered into a strategic partnership with RR Group. Business Segments Being a stationery and office supplies brand, the company has a diverse portfolio of products. As of 2015, FILA raised its stake in DOMS to 51%, investing Rs.

Trade Brains

SEPTEMBER 14, 2023

Founded in 2011. Its portfolio of services to MFs, AIFs, and insurance companies includes API, E-mandate and UPI autopay, FIP integration, integration, AI-focused data analytics, onboarding, fund accounting and operations, and more. .) ₹13,245 EPS ₹57 Stock P/E 29 RoE 14.3% Promoter Holding 39% FII Holding 35.0% Debt to Equity 3.1

Trade Brains

FEBRUARY 26, 2023

Net Profit Margin 18% Operating Profit Margin 24% Founded in 2011 by Ashok Soota, Happiest Minds is an IT solutions & services company. Furthermore, it plans to add 65 more gas retailing stations to its portfolio of 135 stations at present. .) ₹12,500 EPS ₹15.5 Stock P/E 56.1 RoCE 32% RoE 31% Promoter Holding 53.2%

The Better Letter

DECEMBER 15, 2022

Based on the above, nobody should be surprised that 2022 looks like it will be the worst year for the classic 60:40 portfolio since 1937’s -22 percent. Wes created a hypothetical stock portfolio constructed with perfect foresight, invested entirely in the top decile of stocks based on their performance over the upcoming five years.

Trade Brains

AUGUST 6, 2023

The company is an outcome of a demerger scheme that came into effect in April 2011. Combined heat and power can be handled by steam turbines effectively. Therefore, it is a widely used mode of power generation in the process industry. Triveni Engineering & Industries Limited holds a stake of 21.8% in Triveni Turbine Limited (TTL).

Trade Brains

DECEMBER 3, 2023

Smallcase: A platform that offers thematic investment options to its clients with a portfolio of stocks or ETFs. In 2011, it partnered up with Speedo to sell its products in India & Sri Lanka. The Company also earns a bit from its third-party product offering by partnering with Smallcase, Streak, Sensibull, and Vested.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content