At the Money: Managing a Portfolio in a Higher Rate Environment

The Big Picture

APRIL 4, 2024

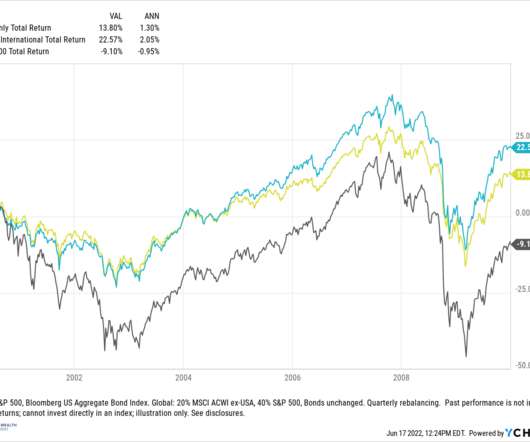

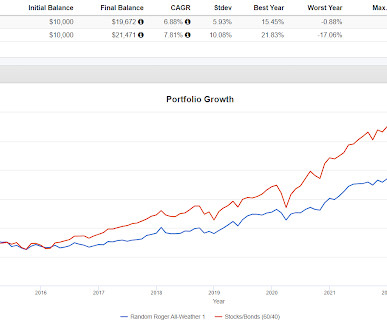

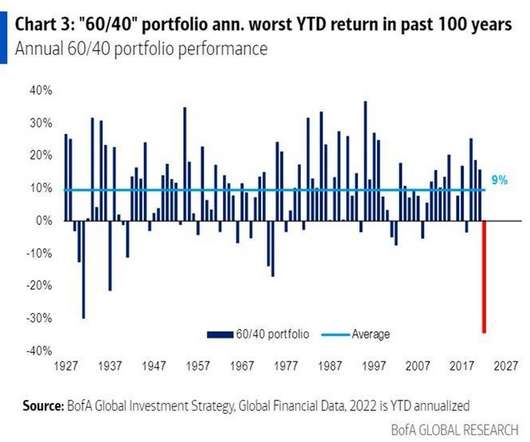

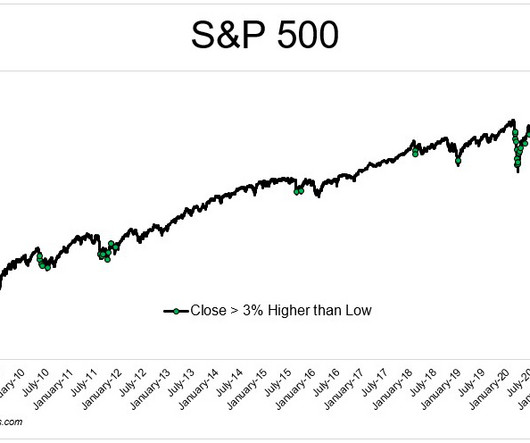

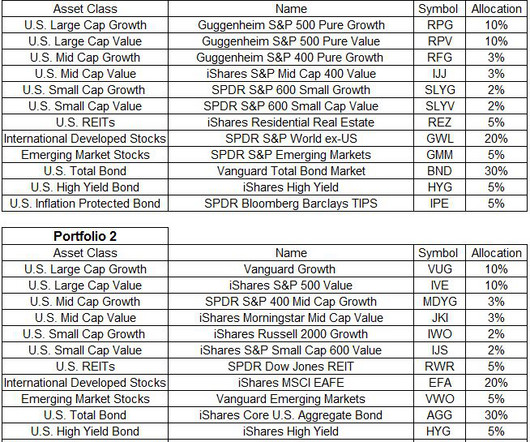

Investors should be considering capturing some of that yield in their portfolios. We’re going to discuss how these changes are likely to affect your portfolios and what you should do about it. My stock portfolio is recovering. This is not the 2009, 2010 to 2020 period where basically all you needed was.

Let's personalize your content