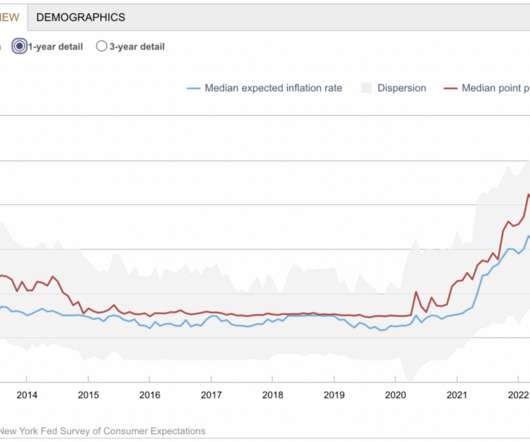

Inflation Expectations: A Dubious Survey

The Big Picture

SEPTEMBER 21, 2022

I have a sneaking suspicion that inflation expectations are overly dependent on 6-foot tall numbers posted nationwide adjacent to roadways showing the price of a commodity that used to be a very significant portion of the family budget but today is a much smaller part of consumer spending. November 22, 2009). Black Friday #Fails.

Let's personalize your content