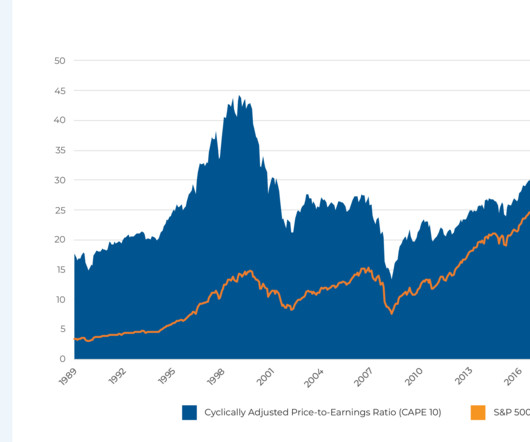

The Most Unattractive Stocks Have Looked Since 2008

Validea

APRIL 27, 2023

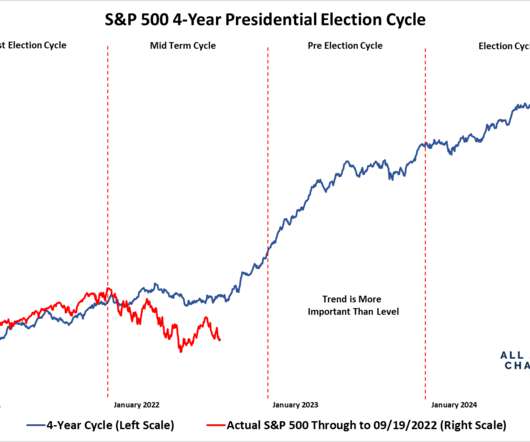

Over the next 12 months, the S&P 500 dropped 45%, the Fed slashed rates down to next-to-nothing, and valuations evened out while bond yields plunged. But high valuations don’t necessarily stem stock prices from going up, and the market is more resilient to rising interest rates now than in the past, the article contends.

Let's personalize your content