Why International Diversification Is Still The Prudent Strategy (While Keeping Behavioral Biases, Risks, And Results In A Healthy Perspective)

Nerd's Eye View

JULY 5, 2023

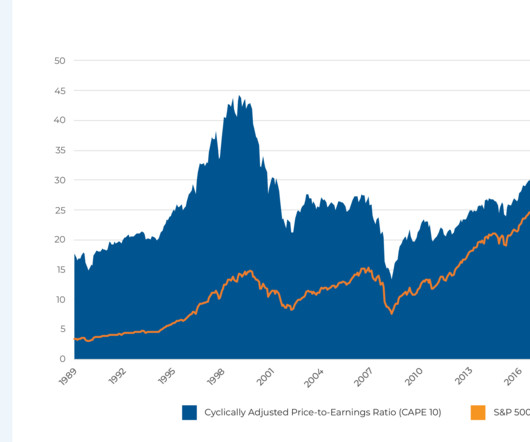

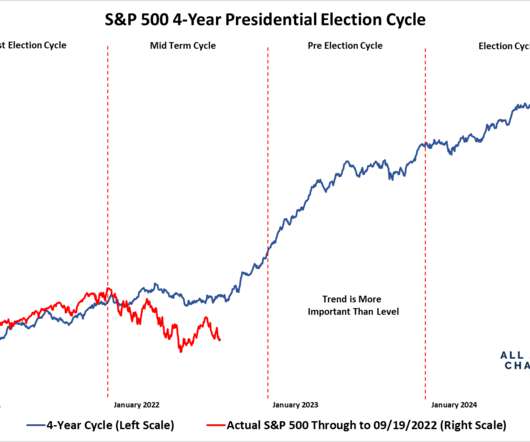

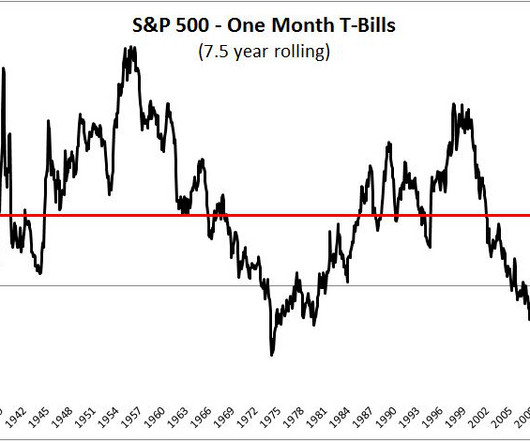

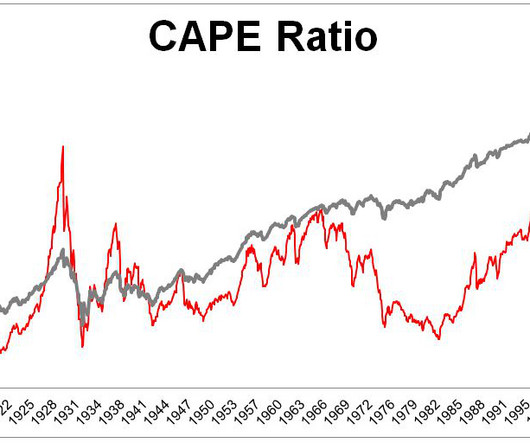

stock market has, on average, outperformed international equities over the last 15 years since emerging from the Great Recession of 2008, many investors argue that international diversification is a poor allocation of dollars that would otherwise be earning more in the U.S. As the U.S. The outperformance of U.S. and global investments.

Let's personalize your content