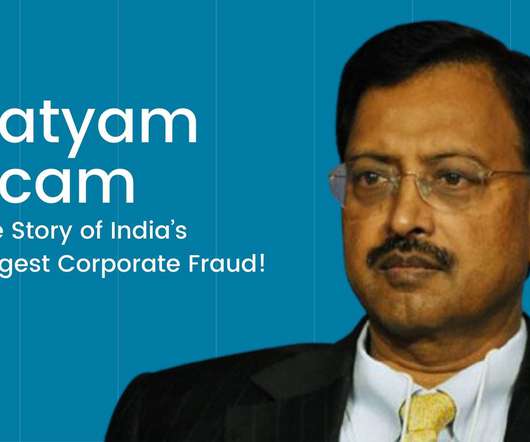

Satyam Scam – The Story of India’s Biggest Corporate Fraud!

Trade Brains

JANUARY 20, 2023

A Case Study on ‘Satyam Scam’ Accounting Scandal: When the 2008 recession hit the world, India was not only going through a financial crisis but also an ethical crisis. Satyam soon went on to cross the $2billion mark in 2008. 544 in 2008. This was what happened with Satyam Computer Services. 7000 crores.

Let's personalize your content