The Frenzy in the Stock Market

Truemind Capital

FEBRUARY 23, 2024

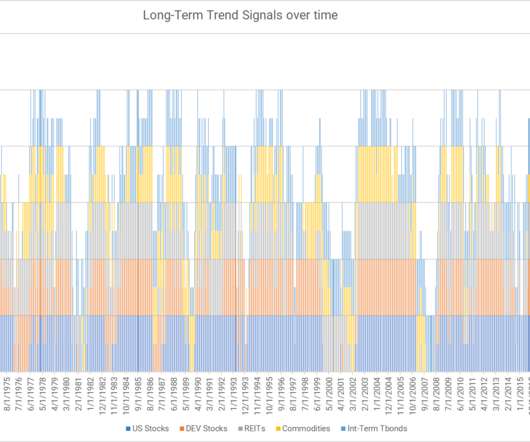

Thinking about all this, I felt I had read about this and observed it in 2007. However, I would insist on following an asset allocation plan with discipline, which is unaffected by the emotions of greed and fear. Asset allocation should follow probabilities of future outcomes along with risk profile.

Let's personalize your content