The Frenzy in the Stock Market

Truemind Capital

FEBRUARY 23, 2024

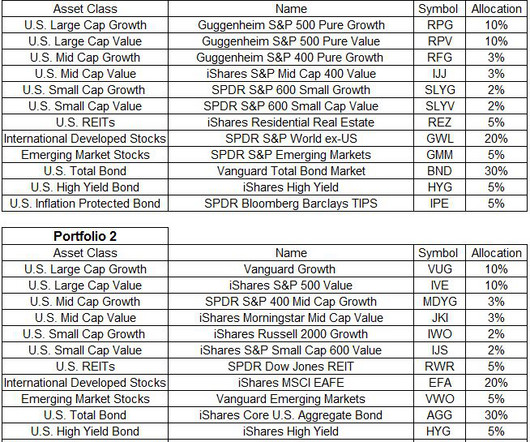

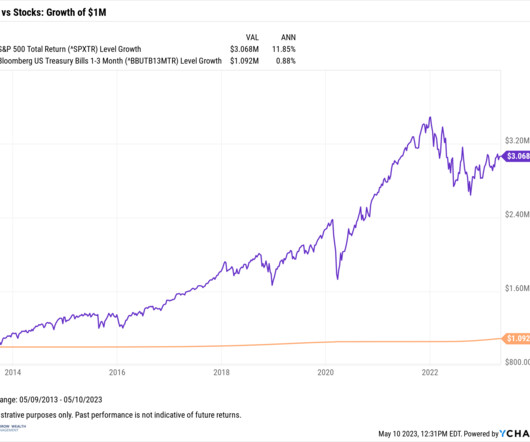

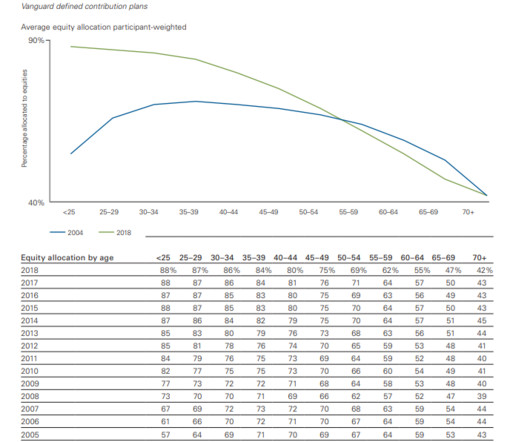

I am also seeing an increasing exposure to equity even in those portfolios where investors have a very low-risk appetite. Thinking about all this, I felt I had read about this and observed it in 2007. However, I would insist on following an asset allocation plan with discipline, which is unaffected by the emotions of greed and fear.

Let's personalize your content