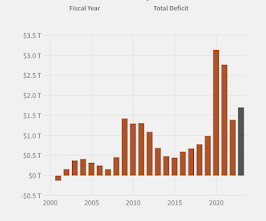

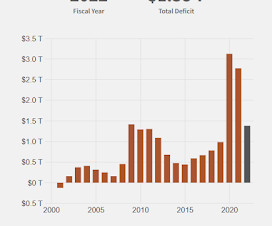

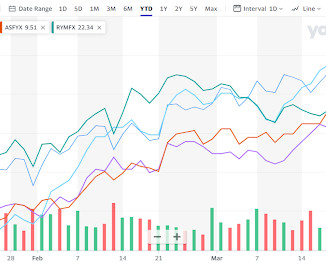

Is the ESG Craze Really Fading?

The Big Picture

NOVEMBER 20, 2023

Previously : Tax Alpha (April 14, 2022) Accessing Losses via Direct Indexing (April 14, 2021) The Cutting Edge (September 30, 2021) USA Is Smashing Its Clean Energy Targets (October 17, 2017) Sources : Wall Street’s ESG Craze Is Fading By Shane Shifflett WSJ, Nov. This is true whether you are pro-life or pro-environment. Oct 31, 2023) 4.

Let's personalize your content