4 Hurdles in Retirement Beyond Your Investment Portfolio

Carson Wealth

MARCH 29, 2023

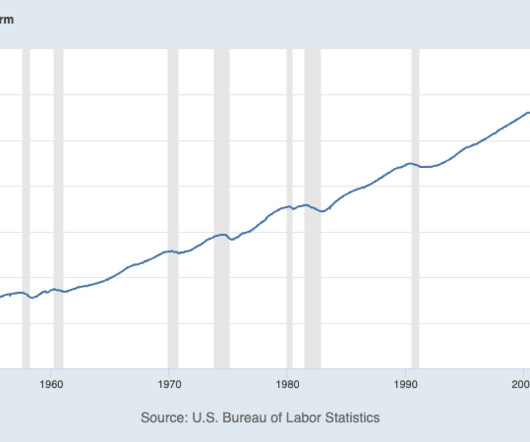

The same is true of retirement planning – if you zero in on your portfolio and nothing else, you’ll miss out on some major factors that can make a significant difference in your retirement and ultimately your bottom line. Taxes can be a huge drain on your retirement funds, and you need to be proactive about planning for them.

Let's personalize your content