Reexamining the Retirement Investment Portfolio

Integrity Financial Planning

OCTOBER 9, 2023

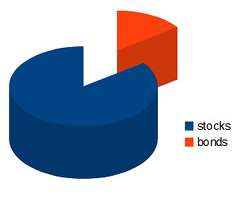

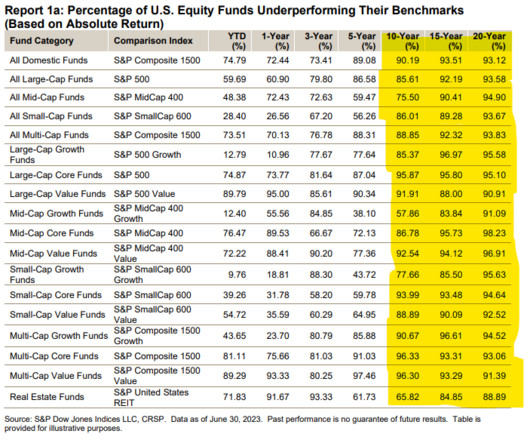

When talking about retirement financial planning, we often take investment strategy at face value. When it comes to retirement, there’s another aspect of income generation that is introduced. An investment portfolio focused on income generation has unique qualities, goals, and risks. [1]

Let's personalize your content