Sunday links: fast pivots

Abnormal Returns

MAY 21, 2023

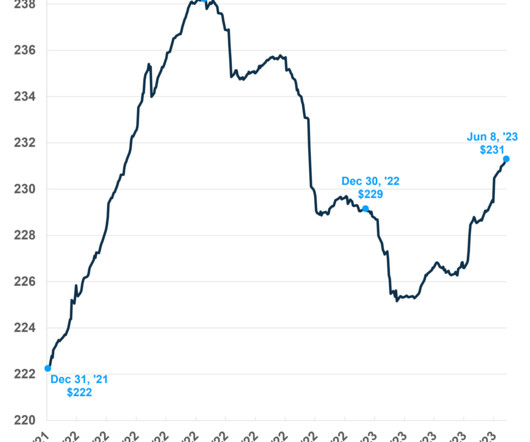

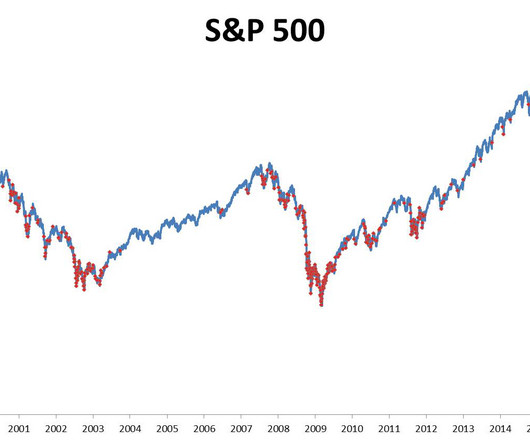

bilello.blog) Strategy Why so many Americans think their house is the best investment. awealthofcommonsense.com) Every investment plan needs some room for error. newsletter.abnormalreturns.com) Mixed media A growing number of New York City office buildings are emptying out. Then check out our weekly e-mail newsletter.

Let's personalize your content