Top clicks this week on Abnormal Returns

Abnormal Returns

APRIL 28, 2024

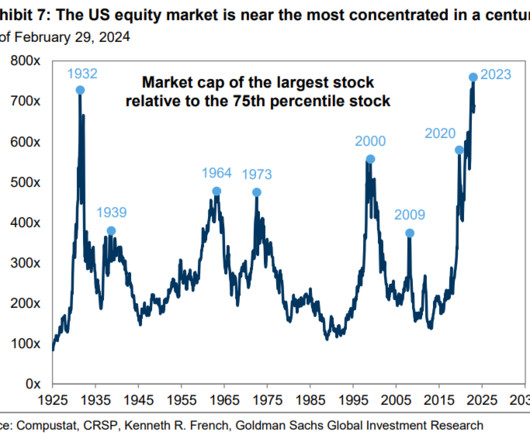

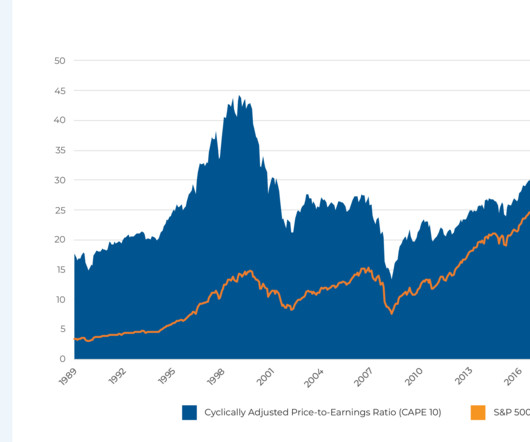

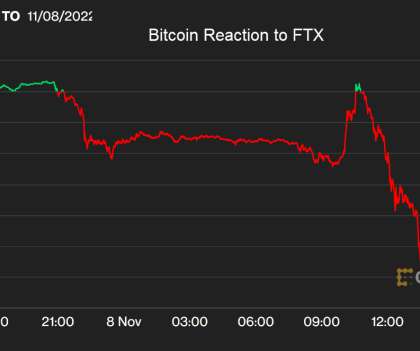

scienceblog.com) What are to make of the big, and persistent, valuation disparities between large and small caps. kk.org) A look at how geopolitical events affect the stock market. (collabfund.com) At what age do we say people are 'old'? carsongroup.com) How much do higher taxes prompt millionaires to relocate?

Let's personalize your content