Market Commentary: Checking In on Market Fundamentals

Carson Wealth

APRIL 8, 2024

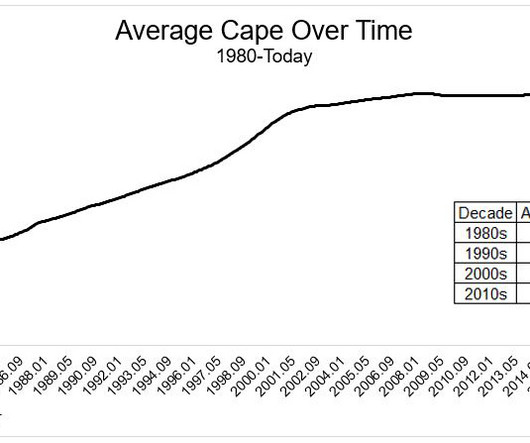

Pockets of attractive valuations exist despite above-average valuations in some high-profile areas of the market. gain, but not a bad number by any means. That means labor productivity continues to run strong, as workers are producing above-trend output while working the same number of hours. Following the huge 11.2%

Let's personalize your content