Market Commentary: Checking In on Market Fundamentals

Carson Wealth

APRIL 8, 2024

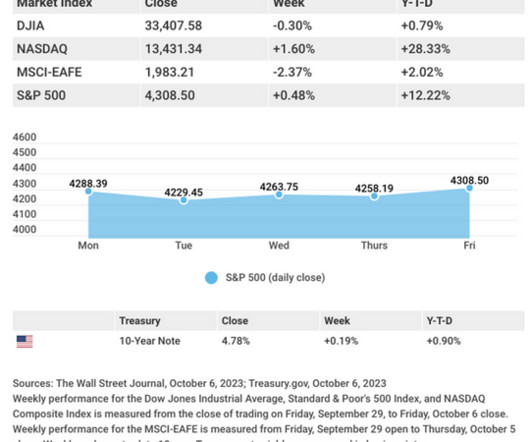

Pockets of attractive valuations exist despite above-average valuations in some high-profile areas of the market. While some commodity prices are rising amid tensions in the Middle East, these events are volatile and prices can reverse just as quickly. Following the huge 11.2%

Let's personalize your content