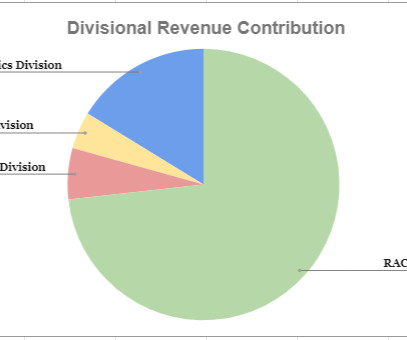

ASM Technologies Vs RIR Power Electronics – Financials, Future Plans & More

Trade Brains

SEPTEMBER 24, 2023

ASM Technologies Vs RIR Power Electronics: The semiconductor industry is often described as the “brain” of modern technology. In today’s article, we will compare two such Indian Companies that are focused on manufacturing such intricate devices – ASM Technologies Vs RIR Power Electronics. Keep reading to know more.

Let's personalize your content