How Listing Fees On Advisory Firm Websites Can Clearly Communicate The Cost (And Value) Of Planning

Nerd's Eye View

MARCH 20, 2023

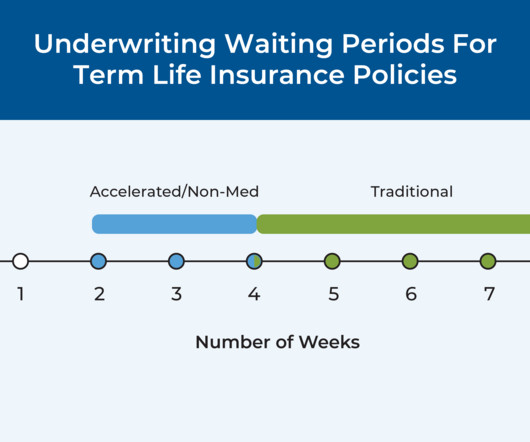

When a prospect is looking for a financial advisor, understanding how much they will need to pay can often be a tricky proposition. In part, this is due to the many commission-based advisors whose compensation depends on the sale of insurance or investment products, where the price that a client pays is baked into the price of the product or is included in (often opaque) fees associated with buying, selling, and/or holding the investment.

Let's personalize your content