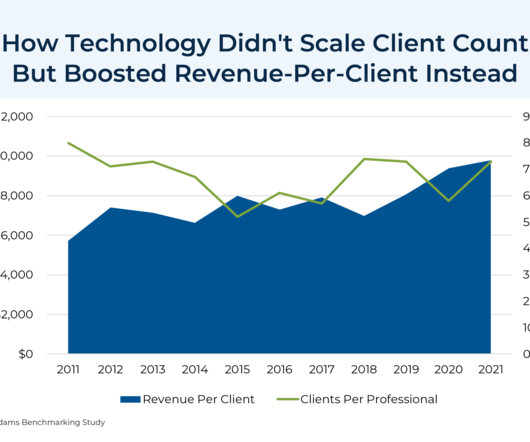

Advisors Are Becoming Better (Not “Faster”) With Advances In #AdvisorTech

Nerd's Eye View

JANUARY 29, 2024

For financial advisors, the promise of technology has always been to help advisors better leverage their time to grow their business. One possible way to do this is to use the time savings of technology to serve a higher number of clients. However, another approach advisors can take is to use their technology to do more – and better – work for the same number of clients while earning higher fees for the higher-value services they provide.

Let's personalize your content