Killer Vees

The Irrelevant Investor

FEBRUARY 28, 2019

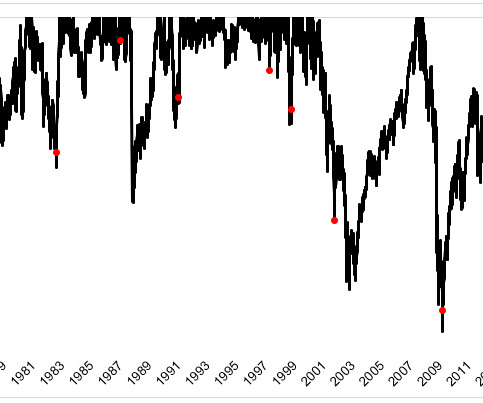

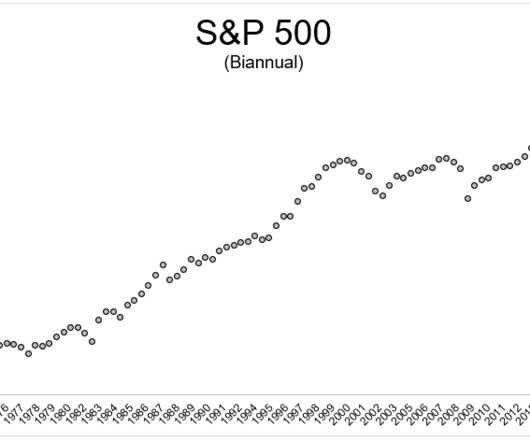

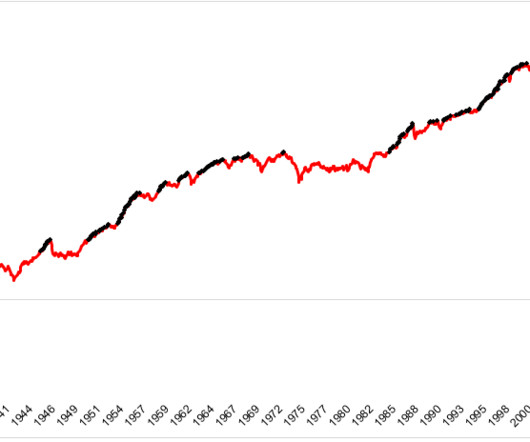

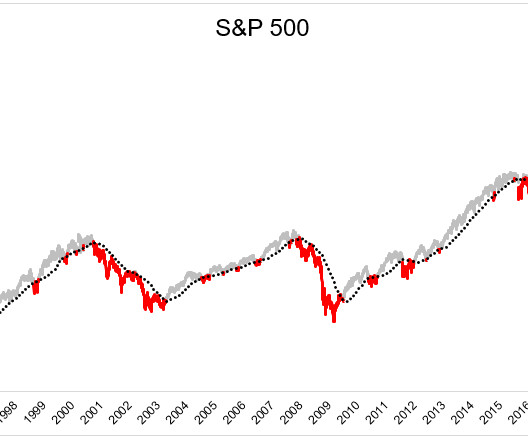

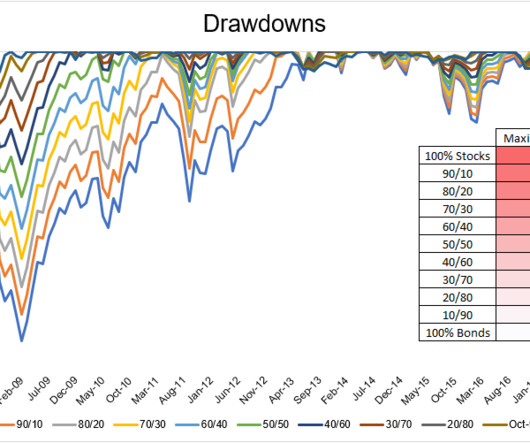

The S&P 500 just rocketed 18% higher in only 44 days. A bounce of this magnitude makes a mockery of risk management. This is the ninth time stocks have experienced a killer vee bottom since 1970. I refer to them as killer vees because they suck for everyone. It makes buy and hold investors sweat and it makes mincemeat of most tactical investors.

Let's personalize your content