Thursday links: margins of safety

Abnormal Returns

SEPTEMBER 7, 2023

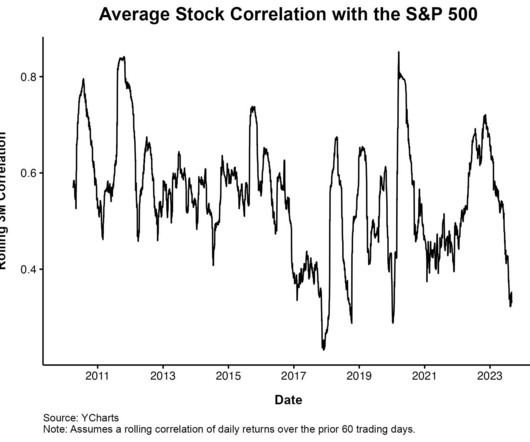

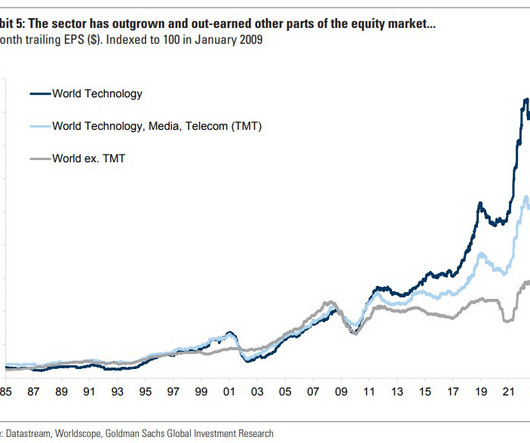

Strategy It's hard to overstate the impact of the big tech stocks on the U.S. stock market of late. (theirrelevantinvestor.com) Big tech stocks have their own valuation experience. (wisdomtree.com) Big Tech has messed with factor investors. (advisorperspectives.com) Finance Blackstone ($BX) was early on the AI trend. (institutionalinvestor.com) Should you buy what Softbank is selling, i.e.

Let's personalize your content