Record 401(k) Participation at Vanguard Plans

The Big Picture

JUNE 15, 2023

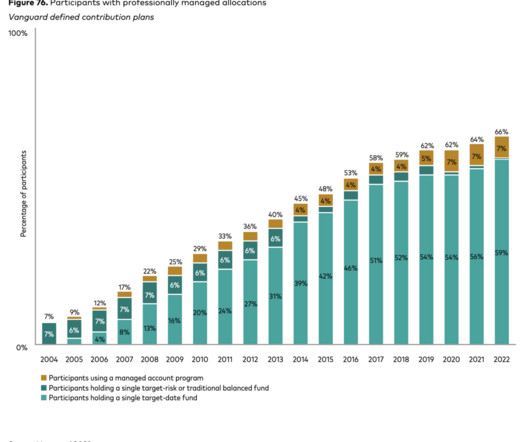

Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America Saves is chock full of data and charts showing how 401k savings have reached all-time highs at Vanguard; I expect other large plan managers like Fidelity and Schwab to be at or near similar levels. VG credits the impact of automatic enrollment/contribution escalation as leading savers to this milestone. “ Record highs in participation, deferral rates, and the use of p

Let's personalize your content