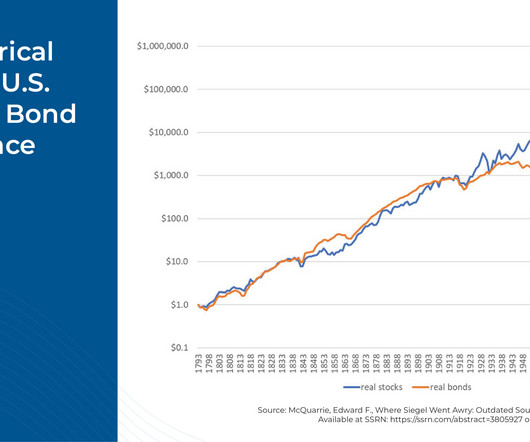

In The Long Run, Stocks Outperform Bonds… Or Do They?

Nerd's Eye View

APRIL 10, 2024

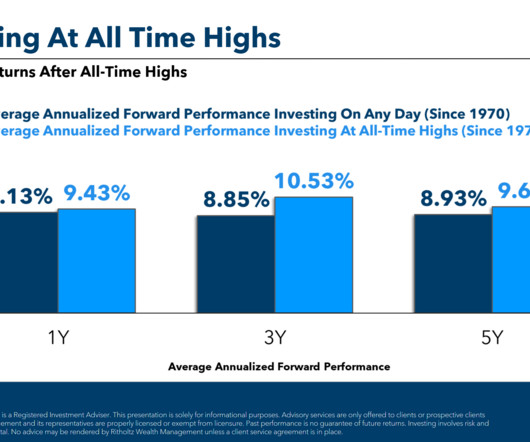

Financial advicers are intimately familiar with the phrase, "Past results are not indicative of future performance." Every document that considers the facts around any particular asset class will invariably include that disclaimer, but constructing a portfolio consisting of a mix of equities, fixed income, and other assets requires investors and advicers to make some fundamental assumptions around long-term expected returns and correlations between assets. 3 common assumptions that have driven a

Let's personalize your content