Planning for Personal Property

Wealth Management

AUGUST 28, 2023

It's key to consider the emotional, financial, and tax implications of gifts of tangible personal property.

Wealth Management

AUGUST 28, 2023

It's key to consider the emotional, financial, and tax implications of gifts of tangible personal property.

Calculated Risk

AUGUST 28, 2023

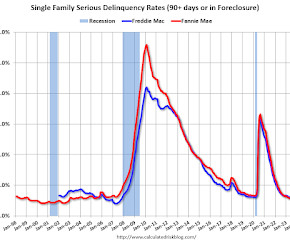

Today, in the Calculated Risk Real Estate Newsletter: Fannie Mae Single-Family Mortgage Serious Delinquency Rate Lowest since 2002 Brief excerpt: Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.54% in July from 0.55% in June. The serious delinquency rate is down year-over-year from 0.76% in July 2022. This is below the pre-pandemic low of 0.65% and the lowest rate since 2002.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

AUGUST 28, 2023

The announcement of the merger between Charles Schwab and TD Ameritrade in November 2019 kicked off a marathon of preparation for advisory firms to transition their clients on the TD Ameritrade custodial platform to Schwab. And with the final conversion of clients scheduled to take place over the upcoming Labor Day weekend of 2023, the marathon is approaching its final sprint toward the finish line.

Wealth Management

AUGUST 28, 2023

Summit Financial Group is departing Securian weeks after Cetera closed a deal to purchase that firm’s retail wealth business.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Abnormal Returns

AUGUST 28, 2023

Charles Schwab Charles Schwab ($SCHW) is rebranding TDA's video news efforts. (riabiz.com) Charles Schwab ($SCHW) is planning more job cuts due to the TDA integration. (investmentnews.com) Pro bono planning Does financial planning have a pro bono problem? (mywealthplanners.com) The CFP Board wants to encourage pro bono planning. (investmentnews.com) Practice management How choosing an advisory niche makes for better marketing efforts.

Wealth Management

AUGUST 28, 2023

Kimco Realty announced it has reached an agreement to purchase RPT Realty in an all-stock deal valued at $2 billion. Wall Street funds that backed WeWork are discussing how to handle the firm’s potential bankruptcy, reports The Wall Street Journal. These are among the must reads from around the real estate investment to kick off the new week.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Wealth Management

AUGUST 28, 2023

The former United Capital business, bought by Goldman in 2019, will bring Creative Planning’s total assets to nearly $275 billion.

Calculated Risk

AUGUST 28, 2023

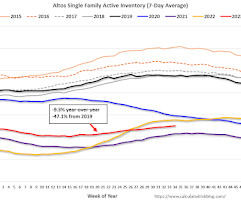

Altos reports that active single-family inventory was up 1.3% week-over-week. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of August 25th, inventory was at 503 thousand (7-day average), compared to 497 thousand the prior week. Year-to-date, inventory is up 2.5%. And inventory is up 24.1% from the seasonal bottom 19 weeks ago.

Wealth Management

AUGUST 28, 2023

Many high-cost major markets that have experienced outmigration still have much larger talent pools than most Sun Belt cities.

Calculated Risk

AUGUST 28, 2023

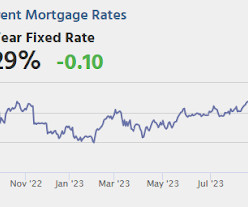

From Matthew Graham at Mortgage News Daily: Rates Relieving Some Pressure After Last Week's Highs Mortgage rates hit fresh multi-decade highs last week with many lenders hitting the mid-7% range earlier in the week for top tier conventional 30yr fixed scenarios. There was some immediate relief on Wednesday, but things have been broadly sideways since then.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

AUGUST 28, 2023

John Love, president and CEO of USCF, talks about the role of commodities as part of investor allocations to alternatives and outlines the firm's ETF strategy.

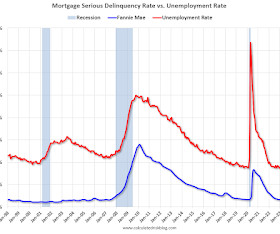

Calculated Risk

AUGUST 28, 2023

Here is a graph of the Fannie Mae mortgage serious delinquency rate and the unemployment rate since 1998 (ht @CharlieAllievo ). For the last two recessions, the delinquency rate and the unemployment rate moved in the same direction. However, there were significant differences between the two periods. During the housing bust, many homeowners had little or no equity - or even negative equity - when prices started falling.

Wealth Management

AUGUST 28, 2023

The Commission is expected to respond to filings from Bitwise, BlackRock, VanEck, WisdomTree and Invesco.

The Big Picture

AUGUST 28, 2023

Econ on the Road Labor, Consumers, Inflation & Data Earlier this month, I spent two and a half hours each way in a car — plus a quick (and horrifying) lunch at the wonderful Eagle’s Nest for Loster Roll and fries. My delightful traveling companions for each way were Dave Nadig of VettaFi + Cameron Dawson at Newedge Wealth. Dave has the best title in all of Wall Street: Financial Futurist.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

AUGUST 28, 2023

Most RPAs are focused on the wrong things.

The Big Picture

AUGUST 28, 2023

My back-to-work morning train WFH reads: • The ‘Fidelity Mafia’ Behind Big Crypto : The mutual-fund powerhouse was a bitcoin pioneer and built a deep talent pipeline for the industry. ( Wall Street Journal ) • Small Multifamily Homes Were Disappearing. Now States Are Scrambling to Revive Them : Construction of low-density housing like duplexes hovers near record lows, as states pass zoning reform to tackle the affordable housing crisis. ( CityLab ) see also Solar Boom Spreads to Timberlands and

Trade Brains

AUGUST 28, 2023

High Promoter Holding Stocks under Rs 50: There are various parameters such as debt level, RoE, etc. investors keep in mind while screening stocks. One such filter is ‘promoter stake’ or ‘promoter shareholding’ in the stock. A high promoter stake acts as a vote of confidence of the company owners towards the business. But with so many listed stocks, how to find out the best among them?

XY Planning Network

AUGUST 28, 2023

We're excited to launch a new series of XYPN member stories entitled "How I Did It." Deciding to take the leap to start your own financial planning firm can be very scary. And actually "leaping" can feel overwhelming. There are so many decisions and responsibilities. How am I going to make this work? What business model should I use? How do I manage compliance?

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

AUGUST 28, 2023

So-called “finfluencers” are preying on naïve investors, promising unrealistic returns while generating excessive commissions for themselves. Their bait is an indexed-universal life (IUL) policy. Read this to avoid making a costly mistake.

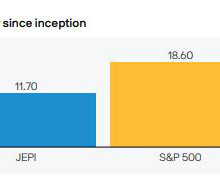

A Wealth of Common Sense

AUGUST 28, 2023

Today’s Talk Your Book is brought to you by J.P. Morgan Asset Management: See here for more information on JPMorgan Equity Premium Income ETF. We had Hamilton Reiner, MD, PM, and Head of US Equity Derivatives at J.P. Morgan Asset Management on the show to discuss their popular covered call strategy ETF. On today’s show, we discuss: How the strategy is constructed Why getting called away on a stock-by-stock b.

Advisor Perspectives

AUGUST 28, 2023

Recently, I came across an example of something worse than having no will…

Investment Writing

AUGUST 28, 2023

Can you spot what’s wrong in the image below? Please post your answer as a comment. This mistake made me laugh, but it’s not funny if your clients spot mistakes like this. I post these challenges to raise awareness of the importance of proofreading. The post MISTAKE MONDAY for August 28: Can YOU spot what’s wrong? appeared first on Susan Weiner Investment Writing.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 28, 2023

Like Samuel Beckett’s titular character Godot, we are still waiting the all-but-certain U.S. recession. It may yet happen, but it’s wise to understand why forecasters were so grossly incorrect.

Darrow Wealth Management

AUGUST 28, 2023

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a lot of work. Most business owners will only experience the process of selling a business once in their life. This is both good and bad news. On the bright side, you only need to get through it once.

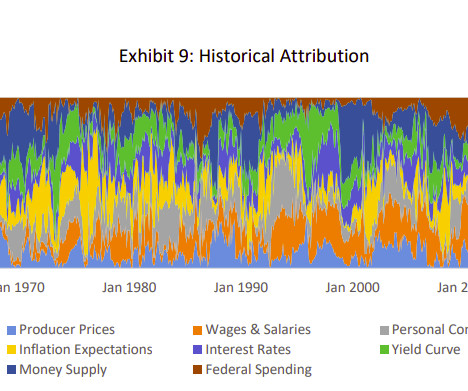

Alpha Architect

AUGUST 28, 2023

The findings from this Hidden Markov Model analysis provide policymakers with valuable insights into the nature and behavior of inflation regimes. This information can inform the design and implementation of monetary, fiscal, and regulatory policies to effectively manage inflation, stabilize the economy, and promote sustainable economic growth. The Determinants of Inflation was originally published at Alpha Architect.

Integrity Financial Planning

AUGUST 28, 2023

Let’s say you’ve just changed jobs. What are you going to do with your 401(k)? You may be able to convert your 401(k) to a Roth IRA, but is that a good option for you? In this article, we’ll talk about what happens when you make this conversion and give you some examples of different financial situations for when this could be the right move for you.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Don Connelly & Associates

AUGUST 28, 2023

Client complaints—it happens to the best of us. Some financial advisors go for years without receiving a client complaint. But it will happen, and when it does, it can seemingly come out of left field. Most client complaints are unexpected, which is why advisors must be able to quickly shift into rapid response gear or risk losing a client. We've posted in the past about the importance of having a systematic communications strategy in developing solid, trusted, and enduring client relationships.

XY Planning Network

AUGUST 28, 2023

We're excited to launch a new series of XYPN member stories entitled "How I Did It." Deciding to take the leap to start your own financial planning firm can be very scary. And actually "leaping" can feel overwhelming. There are so many decisions and responsibilities. How am I going to make this work? What business model should I use? How do I manage compliance?

Don Connelly & Associates

AUGUST 28, 2023

Client complaints—it happens to the best of us. Some financial advisors go for years without receiving a client complaint. But it will happen, and when it does, it can seemingly come out of left field. Most client complaints are unexpected, which is why advisors must be able to quickly shift into rapid response gear or risk losing a client. We've posted in the past about the importance of having a systematic communications strategy in developing solid, trusted, and enduring client relationships.

Advisor Perspectives

AUGUST 28, 2023

Applying planning expertise is a very complicated art form, a skill that is acquired over time, but which can be accelerated if there were a way to capture many of things that soon-to-be-retired advisors have learned through years of practice.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content