Weekend Reading For Financial Planners (November 25-26)

Nerd's Eye View

NOVEMBER 24, 2023

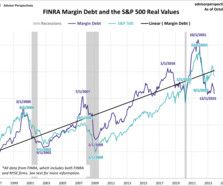

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that FINRA has issued a proposal to allow broker-dealers to advertise hypothetical performance data to institutional and high-net-worth investors, which would bring the rules for broker-dealers largely in line with those for investment advisers, but also raises questions about the comparative roles and regulations for the two groups.

Let's personalize your content