#FA Success Ep 346: Moving Procrastinating Clients To “Yes” Instead Of Selling As A Fee-Only Advisor, With Jim Ludwick

Nerd's Eye View

AUGUST 15, 2023

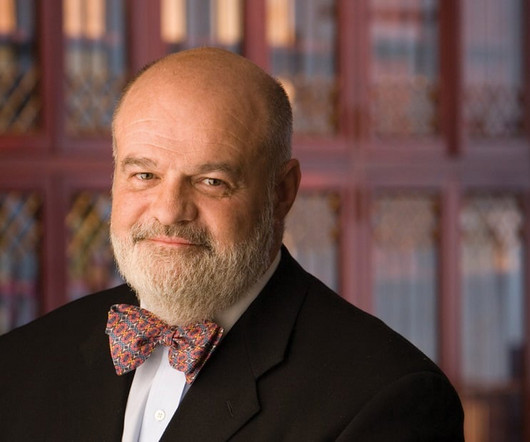

Welcome back to the 346th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jim Ludwick. Jim is the founder of MainStreet Financial Planning, an hourly, fee-only financial planning firm, and also created Procrastination Junction, a coaching program for fee-only financial advisors looking to improve their sales skills.

Let's personalize your content