A Feud is Brewing Over Dianne Feinstein’s Husband’s Estate

Wealth Management

JULY 28, 2023

The long-tenured senator's daughter has filed two separate lawsuits on her behalf.

Wealth Management

JULY 28, 2023

The long-tenured senator's daughter has filed two separate lawsuits on her behalf.

Nerd's Eye View

JULY 28, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that RIAs appear to be building more comprehensive and more integrated tech stacks, and are benefiting from greater operational efficiencies, according to the latest Schwab RIA Benchmarking Study, with larger firms seeing gains in clients and AUM per professional and a reduction in annual hours spent per client for operations and administration in the past 3 y

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 28, 2023

Wealth management is still a growth industry. We’ll never have enough advisors to serve every potential client. So when organic growth hits a wall, it’s exciting to watch the industry’s hungriest, most inventive leaders find a way over it. Instead of hunkering down, they’re busy seizing new opportunities. Here’s how to do the same.

Calculated Risk

JULY 28, 2023

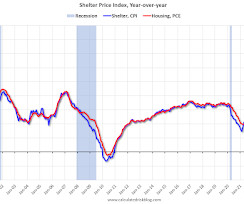

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through June 2023. CPI Shelter was up 7.8% year-over-year in June, down from 8.0% in May, and down from the cycle peak of 8.2% in March 2023. Housing (PCE) was up 8.0% YoY in June , down from 8.3% in May, and down from the cycle peak of 8.4% in April 2023.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JULY 28, 2023

Following the announcement of its acquisition of Crown Capital Securities, LPL said it added $19 billion in recruited assets and 421 net new advisors during the second quarter.

Abnormal Returns

JULY 28, 2023

Markets More signs that the U.S. stock market is overbought. (capitalspectator.com) The Series I savings bond frenzy is over. (bloomberg.com) Individual investors have a lot of advantages over professional investors. (awealthofcommonsense.com) Big Tech All things considered, Meta ($META) and Google ($GOOGL) dominate online ad spending. (marketwatch.com) How Amazon ($AMZN) is targeting AI.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 28, 2023

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 4.4% Below Peak; Price-to-rent index is 7.9% below recent peak Excerpt: It has been over 17 years since the bubble peak. In the May Case-Shiller house price index released Tuesday, the seasonally adjusted National Index (SA), was reported as being 64% above the bubble peak in 2006.

Wealth Management

JULY 28, 2023

Aspiriant, Key Private Bank and Merrill Lynch lost advisors to Manhattan West and Steward Partners in moves announced this week, while F.L.Putnam expanded in Maine.

Calculated Risk

JULY 28, 2023

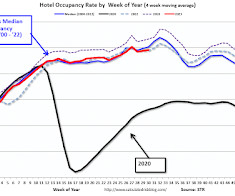

From STR: U.S. hotel results for week ending 22 July U.S. hotel performance increased from the previous week and showed improved comparisons year over year, according to CoStar’s latest data through 22 July. 16-22 July 2023 (percentage change from comparable week in 2022): • Occupancy: 72.9% (+0.5%) • Average daily rate (ADR): US$161.65 (+1.5%) • Revenue per available room (RevPAR): US$117.91 (+2.0%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy rate using

Wealth Management

JULY 28, 2023

Running your office doesn’t have to mean running in circles.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

JULY 28, 2023

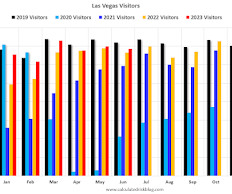

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions). From the Las Vegas Visitor Authority: June 2023 Las Vegas Visitor Statistics Punctuated by the Vegas Golden Knights' victorious quest for the Stanley Cup, Las Vegas visitation in June surpassed last year as the destination hosted more than 3.4M visitors, +3.1% YoY.

Wealth Management

JULY 28, 2023

The wealth management industry has been transformed with the advent of remote and hybrid work.

Calculated Risk

JULY 28, 2023

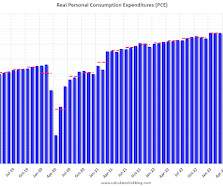

The BEA released the Personal Income and Outlays report for June: Personal income increased $69.5 billion (0.3 percent at a monthly rate) in June , according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $67.5 billion (0.3 percent) and personal consumption expenditures (PCE) increased $100.4 billion (0.5 percent).

The Reformed Broker

JULY 28, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, JC Parets, and Downtown Josh Brown discuss value vs growth, JC’s favorite charts right now, volatility strategies, US homeowner equity, a strategist short squeeze, Lionel Messi in Miami, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Big Picture

JULY 28, 2023

My end-of-week morning train WFH reads: • A Textbook Non-Recessionary Bear Market : I don’t think the bear market was an overreaction either considering the changes we saw to inflation and interest rates. Plus we had such a large run-up in prices in 2020 and 2021 that it was good for knocking down the speculation that was running rampant.

A Wealth of Common Sense

JULY 28, 2023

On the first day of my internship working for a group of sellside investment analysts as a senior in college, my boss told me to read the Wall Street Journal from cover to cover every morning. He said something to the effect of, “You obviously don’t know anything about the markets so start reading…and keep reading.” Guilty as charged.

Alpha Architect

JULY 28, 2023

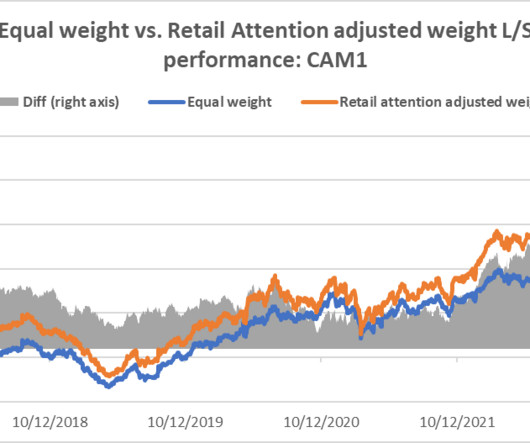

By using a novel measure of investor attention, generated from InvestingChannel’s clickstream data on online financial news consumption, we can identify broad groups of stocks which are less efficiently priced and therefore where anomalies such as Value and Momentum are likely to produce greater cross sectional differentiation in returns. We also apply these groupings to proprietary ExtractAlpha stock selection signals.

Trade Brains

JULY 28, 2023

Best Low PE Penny Stocks : Most of the time investors are in search of the best stocks to earn multi-bagger returns with lower risk. One of the best ways to achieve it is through buying penny stocks. But, as a cautious investor, it is essential to secure the capital downside also with proper research and analysis. In this article, let us explore a few of the best low PE Penny Stocks in India to earn good returns.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

JULY 28, 2023

Don’t fear the Fed’s 25-basis-point rate hike on Wednesday, according to Jeremy Siegel. Given the strength of the economy and low unemployment, he said stocks can withstand higher rates.

Trade Brains

JULY 28, 2023

Should you buy Tata Elxsi Shares – After hitting the ATH in August 2022, the stock price plummeted and almost lost half its value in the next 7 months. In the next 5 minutes, I’ll walk you through the most important points about Tata Elxsi, including fundamentals, technicals, analyst ratings, and retail sentiment on Stocktwits , which will help you in your decision-making process.

Good Financial Cents

JULY 28, 2023

When we mention nine-figure sums, we’re talking about a truly astronomical level of wealth. To put it in perspective, nine figures represent anything from $100,000,000 all the way up to $999,999,999. This figure surpasses the GDP of several small nations. For instance, Samoa reported a GDP of approximately 843.8 million USD in 2021. Or consider that according to Investopedia , 7-figure wealth is what puts you among the top 0.1% of the wealthiest people on the planet.

Discipline Funds

JULY 28, 2023

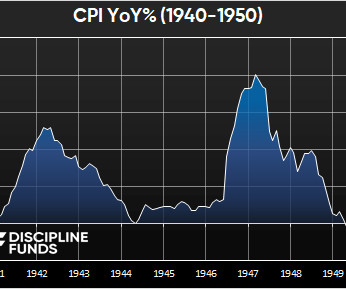

The Federal Reserve has expressed concerns about a double bump in inflation. That is a scenario where inflation surges and then jumps higher again for various reasons (such as the Fed letting off the brakes too early). The most common period of concern is the 1970s where inflation surged in the 1973-1975 period, cooled a bit and then surged higher from 1978-1980.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

David Nelson

JULY 28, 2023

David Nelson launches The Money Runner. In the end money touches everything. The show will take on topics that resonate from Wall Street to Main Street and of course Washington.

SEI

JULY 28, 2023

Chief Investment Officer Jim Smigiel provides an overview of the global financial markets during the second quarter and our perspective on them.

Advisor Perspectives

JULY 28, 2023

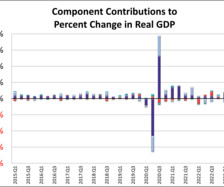

Real gross domestic product (GDP) is comprised of four major subcomponents. In the Q2 GDP advance estimate, three out of the four components made positive contributions and one component made negative contributions.

Indigo Marketing Agency

JULY 28, 2023

Have you ever posted an ad on LinkedIn and questioned whether the copy was too long or if you should target a different audience? There are many variables that go into creating a successful ad campaign on LinkedIn, including ad copy, visuals, call-to-action buttons, audience targeting, and more. So, how can financial advisors make the best decisions about which elements are most effective for their LinkedIn ads?

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

NAIFA Advisor Today

JULY 28, 2023

I was reading an analysis the other day and they quoted a study saying a third of entrepreneurs plan on investing more in training, specifically sales, in the economic uncertainty. And we all know that in uncertain times and recession, investing in skills and sales are the best investments possible.

Clever Girl Finance

JULY 28, 2023

Let’s talk about grocery shopping on a budget. You can cut lattes and your cable bill, but the one thing you can’t cut from your budget? Food. Food is expensive. Whether you’re a student on a low budget or a parent trying to keep the food bills at bay, we could all use some tips on managing our grocery budget properly so we can save more money.

Advisor Perspectives

JULY 28, 2023

Building wealth isn't difficult, so why don't people do it? As younger generations reach the point where they have finally saved enough to begin investing it may seem overwhelming to know where to start.

Inside Information

JULY 28, 2023

Oscar Wilde once remarked that “A fool is someone who knows the price of everything and the value of nothing.” I think that lesson is being played out before our eyes in the financial planning profession, only instead of ‘fool’ in that quote, you can substitute ‘private equity firm,’ or ‘bean counter.’ Ever since I wrote the article telling stories about firms that were acquired, and the issues that the acquired advisors faced in their new workplaces, I’ve been looking a bit harder at the curre

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content