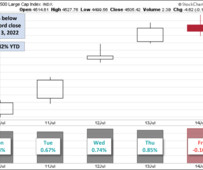

Quarterly Pattern of Earnings Have Returned to Normal

The Big Picture

JULY 14, 2023

Jim Reid of Deutsche Bank notes the pattern of gradual downgrades before earnings season begins is back to normal. As the rest of the quarterly earnings roll out, we should expect earnings to improve as we roll deeper into earnings season and as “later estimate beats” come in. This quarterly earnings pattern is shown above in the chart from his colleague Binky Chadha.

Let's personalize your content