Monday links: sowing and reaping

Abnormal Returns

JANUARY 8, 2024

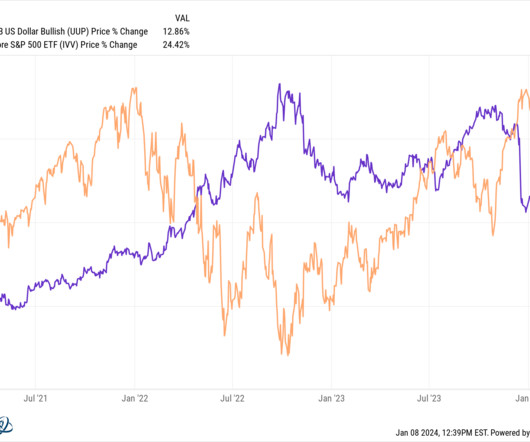

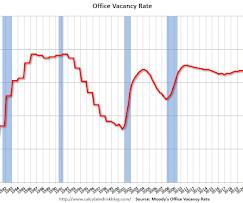

Markets Six reasons to bullish. Six reasons to be bearish. (ritholtz.com) The 10 biggest FTSE 100 companies by market cap, over time. (ft.com) What you need to know about the spread on mortgage bonds. (housingbrief.com) Finance The spot Bitcoin ETF price war is already on. (axios.com) Property and casualty insurance providers are struggling to keep up with weather-related claims.

Let's personalize your content