Thursday links: a million variables

Abnormal Returns

DECEMBER 14, 2023

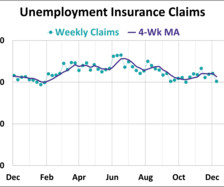

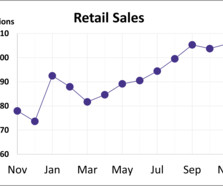

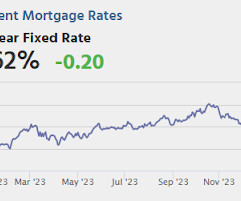

Markets Some data matters more than others for the stock market. (theirrelevantinvestor.com) All the price trends are headed in the right direction. (capitalspectator.com) Global The FTSE 100 trades around 10x earnings. (economist.com) Why Japanese retail investors are notoriously equity-averse. (ft.com) Strategy Historically the stock market recovers to all-time highs, sometimes it just takes time.

Let's personalize your content