Top clicks this week on Abnormal Returns

Abnormal Returns

SEPTEMBER 10, 2023

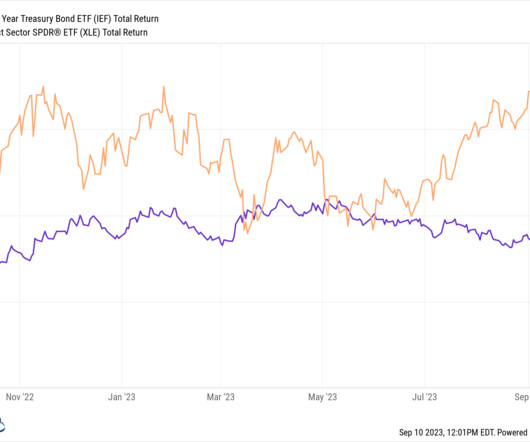

Also on the site Public predictions are exhausting. (abnormalreturns.com) Top clicks this week How investors should re-think about their bond allocations. (awealthofcommonsense.com) What investors get wrong about the 'Yale Model.' (capitalallocators.com) How investors should think about their bond allocations. (blog.validea.com) How an inverted yield curve affects stock and bond market returns.

Let's personalize your content