10 Thursday AM Reads

The Big Picture

DECEMBER 7, 2023

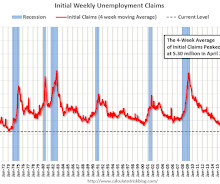

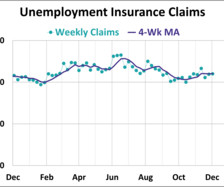

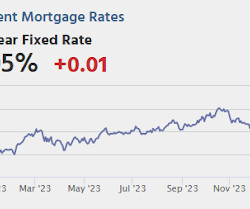

My morning train WFH reads: • How much should it cost to sell a house? Your real estate agent may be charging too much. Why should homebuyers and sellers pay for services they neither want nor use? It’s like being forced to pay a travel agent commission when booking a flight directly online. ( USA Today ) • Signs of a Weakening Job Market, in Five Charts : Openings and quits data could give clues to the direction of hiring and the economy. ( Wall Street Journal ) see also Pay Thousands to

Let's personalize your content