Foul Mood?

The Big Picture

MAY 24, 2023

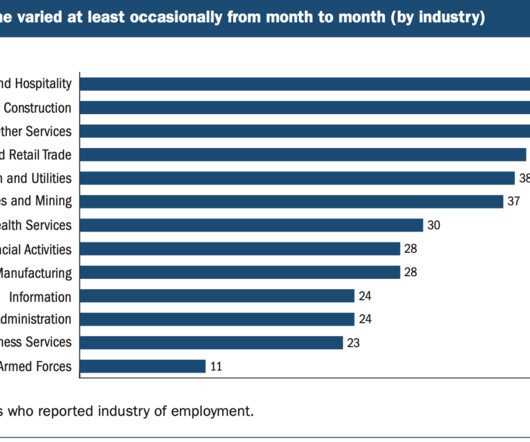

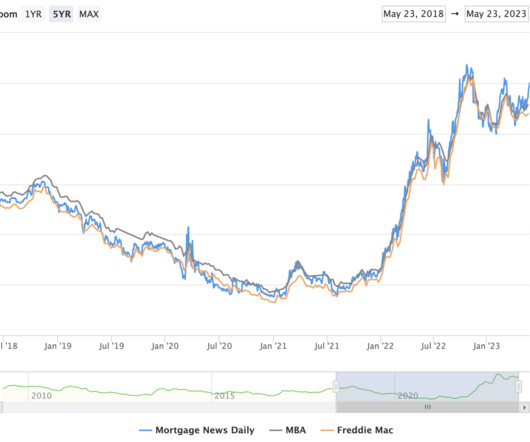

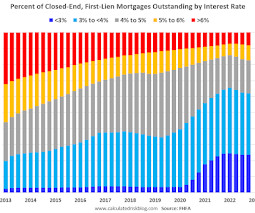

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022. It’s chock full of great charts and analyses, covering everything from Income, Employment, Expenses, Banking and Credit, Housing, Student Loans, Retirement and Investments, and Overall Financial Well-Being. Peter Coy fleshes out lots of the details here: “ Unemployment Is Low, But So Is the National Mood.” He notes: “The Fed report is consistent with ot

Let's personalize your content