A Luxury Slowdown

The Reformed Broker

OCTOBER 17, 2023

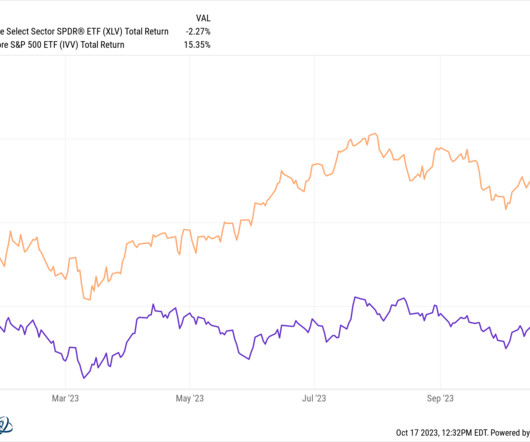

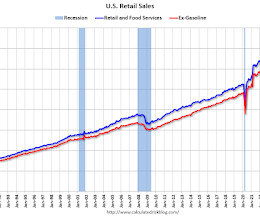

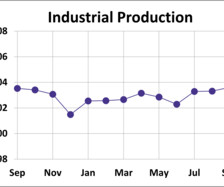

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Earnings – “Average commercial and consumer loans were both down from the second quarter as higher rates and a slowing economy have weakened loan demand, and we’ve continued to take some credit tighteni.

Let's personalize your content