Tuesday links: the AI genie

Abnormal Returns

JANUARY 10, 2023

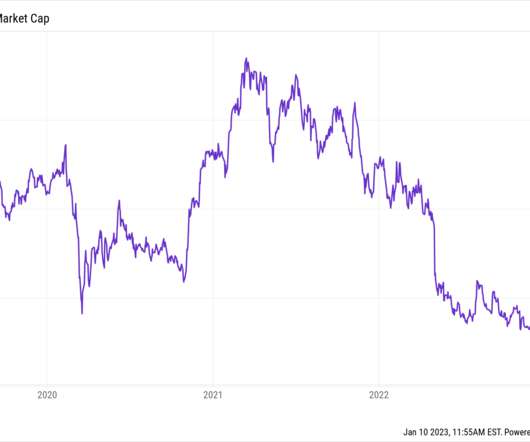

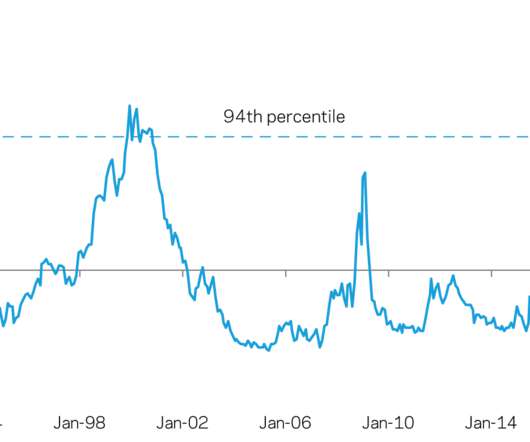

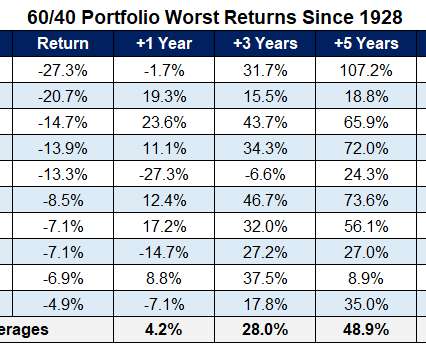

Markets What role do interest rates have in stock prices? (ofdollarsanddata.com) Why the golden age of biotech stocks may be over. (statnews.com) Crypto Coinbase ($COIN) is laying off 20% of its workforce. (cnbc.com) Why so many are focused on the big discount on the Grayscale Bitcoin Trust ($GBTC). (blockworks.co) Could another firm actually take over management of GBTC?

Let's personalize your content