National Association of Realtors Is Imploding

The Big Picture

OCTOBER 13, 2023

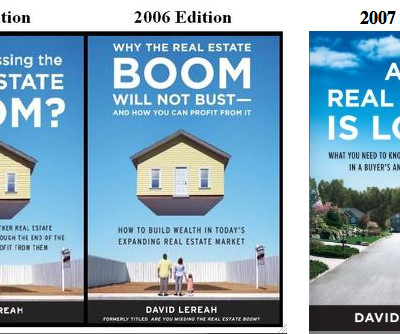

My buddy Jonathan Miller does not hesitate to call out the weasels who represent those who work in his industry: NAR Proves That Trade Groups Aren’t Infallible With an appalling culture of secrecy maintained by wildly overpaid executives (I believe their CEO is paid close to $3 million per year), NAR seems to be imploding right now. These three prominent real estate firms are backing away from the management cesspool that has severely damaged the National Association of Realtors (NAR) brand.

Let's personalize your content