Groping for a Bottom

The Big Picture

OCTOBER 14, 2022

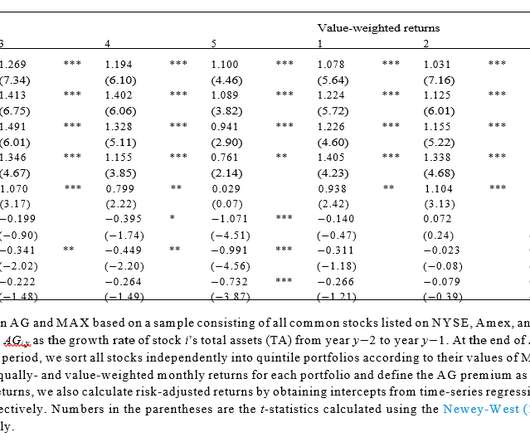

There’s nothing like confusing market action to send people into narrative creation overdrive. Yesterday’s 2% collapse on hotter-than-expected CPI data, followed by ~5% recovery to finish the day up more than 2% is a perfect example of random market action begetting endless explanations. What was the takeaway from CPI? Check out the BAML chart above: Core goods are coming down ( that’s good!

Let's personalize your content