Sunday links: fast pivots

Abnormal Returns

MAY 21, 2023

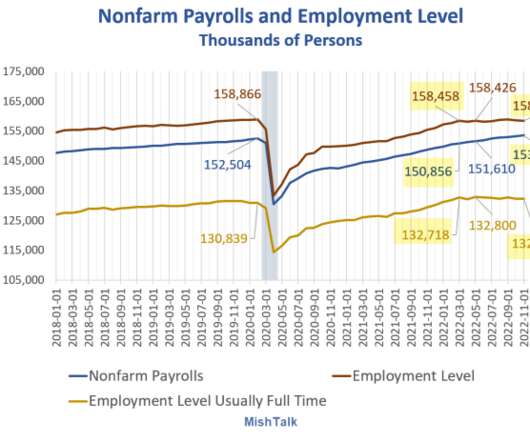

wsj.com) Apple ($AAPL) is playing the long game in financial services. washingtonpost.com) Economy American consumer behavior is normalizing. tker.co) The mix of light vehicle sales keeps shifting toward pickups and SUVs. calculatedriskblog.com) The economic schedule for the coming week.

Let's personalize your content