5 Questions Using Risk Assessment Data That Help Advisors Understand Clients’ True Concerns About Risk

Nerd's Eye View

MAY 8, 2024

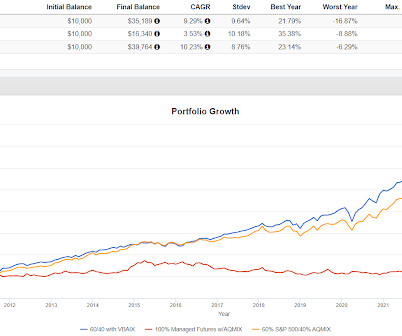

Measuring a client's tolerance for risk is an essential (and required!) step when onboarding a new client, as making any sort of recommendation is impossible without first understanding how comfortable clients may be when their portfolios inevitably experience volatility. Would you agree to this investment?").

Let's personalize your content