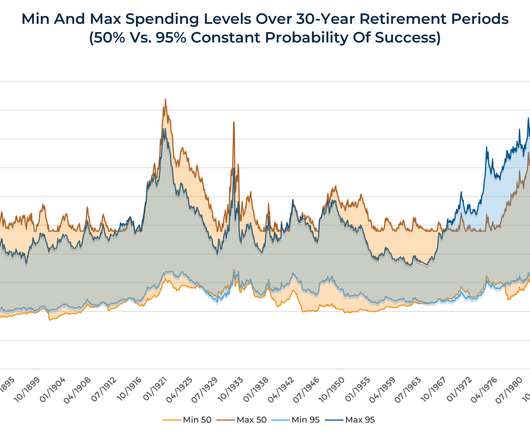

Reframing Risk In Retirement As “Over- And Under-Spending” To Better Communicate Decisions To Clients, And Finding “Best Guess” Spending Level

Nerd's Eye View

APRIL 24, 2024

Over the past few decades, advicers have used Monte Carlo analysis tools to communicate to clients if their assets and planned level of spending were sufficient for them to realize their goals while (critically) not running out of money in retirement.

Let's personalize your content