Air Bags Deployed to Cushion Bank Crashes

Investing Caffeine

APRIL 3, 2023

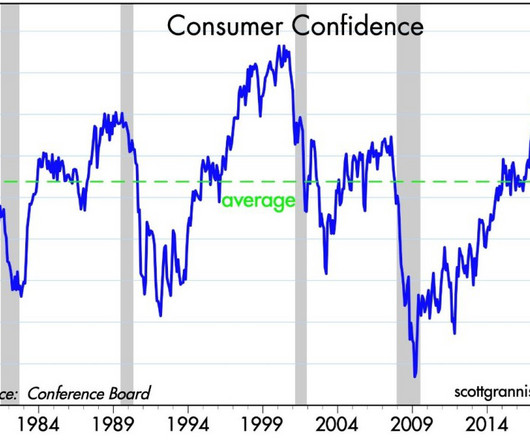

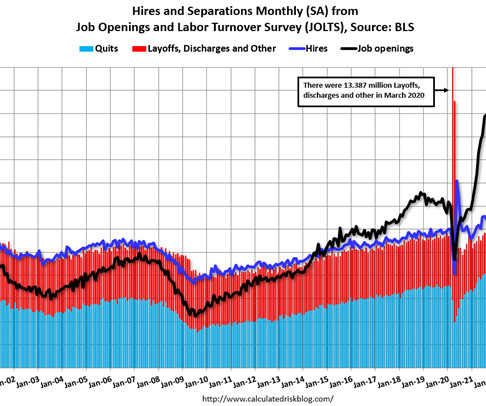

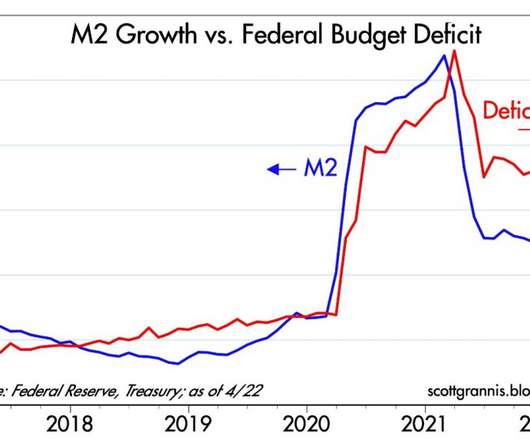

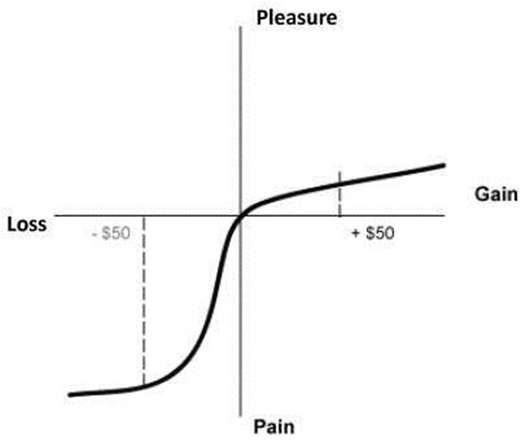

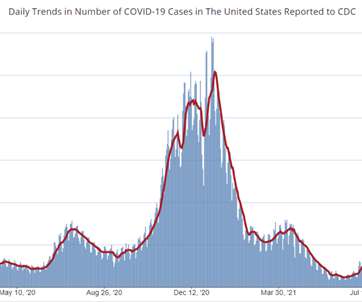

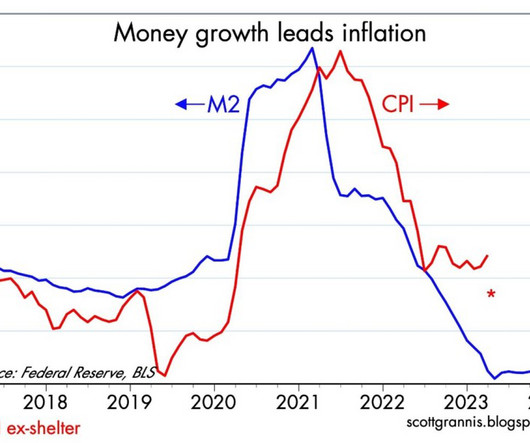

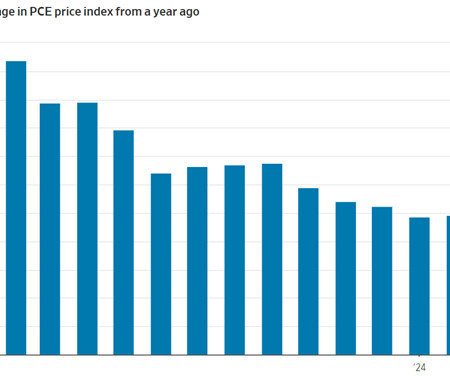

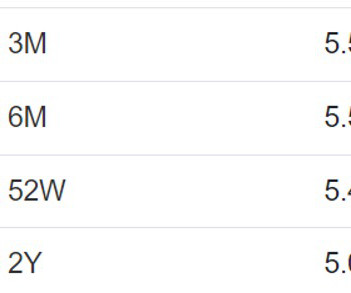

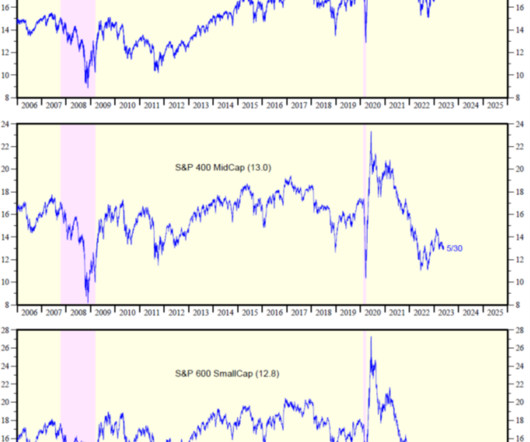

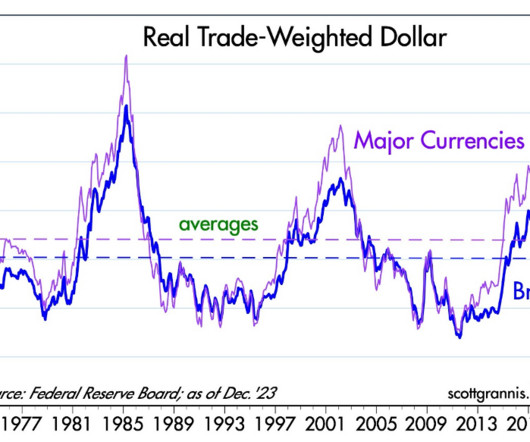

In recent years, COVID and a ZIRP (Zero Interest Rate Policy) caused out-of-control inflation to swerve the economy in the wrong direction. Investors were generally relieved by the government’s response, and the financial markets reacted accordingly. economy has been greatly exaggerated. Slome, CFA, CFP ® Plan.

Let's personalize your content