MiB: Peter Borish, Tudor Investments & Robin Hood

The Big Picture

JUNE 24, 2023

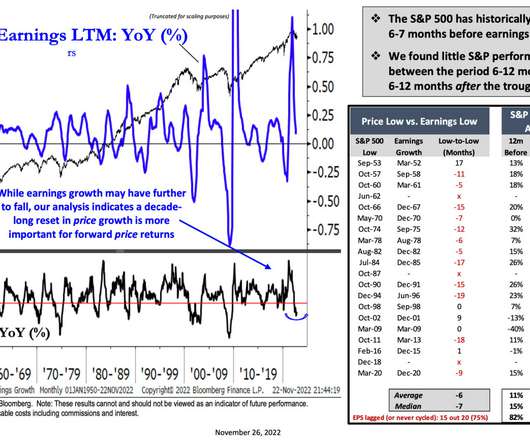

His philanthropy includes sitting on the board of directors of Paul Tudor Jones’ Robin Hood Foundation and Jim Simon’s Math for America. That setup plus the mistaken belief that Portfolio Insurance would offer protection from losses, was the perfect up parallel.

Let's personalize your content